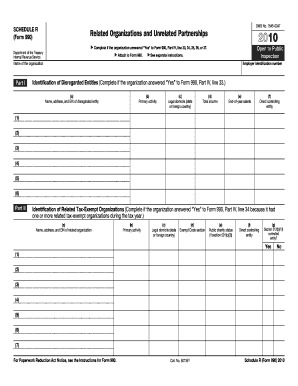

Get 2010 Form 990 (schedule R). Related Organizations And Unrelated Partnerships - Irs

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign 2010 Form 990 (Schedule R). Related Organizations And Unrelated Partnerships - Irs online

How to fill out and sign 2010 Form 990 (Schedule R). Related Organizations And Unrelated Partnerships - Irs online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Tax, legal, business and other electronic documents demand an advanced level of protection and compliance with the law. Our documents are updated on a regular basis in accordance with the latest amendments in legislation. In addition, with us, all of the information you provide in the 2010 Form 990 (Schedule R). Related Organizations And Unrelated Partnerships - Irs is well-protected against loss or damage via industry-leading file encryption.

The following tips will allow you to complete 2010 Form 990 (Schedule R). Related Organizations And Unrelated Partnerships - Irs easily and quickly:

- Open the document in the full-fledged online editing tool by hitting Get form.

- Complete the required boxes which are yellow-colored.

- Press the green arrow with the inscription Next to move from field to field.

- Go to the e-signature tool to put an electronic signature on the template.

- Insert the relevant date.

- Double-check the whole template to make sure you haven?t skipped anything important.

- Press Done and save the new form.

Our platform allows you to take the whole procedure of executing legal papers online. For that reason, you save hours (if not days or even weeks) and eliminate additional expenses. From now on, fill out 2010 Form 990 (Schedule R). Related Organizations And Unrelated Partnerships - Irs from your home, business office, or even on the go.

How to edit 2010 Form 990 (Schedule R). Related Organizations And Unrelated Partnerships - Irs: customize forms online

Say goodbye to an old-fashioned paper-based way of executing 2010 Form 990 (Schedule R). Related Organizations And Unrelated Partnerships - Irs. Get the form filled out and certified in minutes with our professional online editor.

Are you forced to revise and fill out 2010 Form 990 (Schedule R). Related Organizations And Unrelated Partnerships - Irs? With a robust editor like ours, you can complete this in only minutes without the need to print and scan paperwork back and forth. We provide you with completely customizable and straightforward form templates that will serve as a start and help you fill out the required document template online.

All files, automatically, come with fillable fields you can execute as soon as you open the template. However, if you need to improve the existing content of the form or insert a new one, you can select from various editing and annotation options. Highlight, blackout, and comment on the document; add checkmarks, lines, text boxes, graphics and notes, and comments. Additionally, you can swiftly certify the template with a legally-binding signature. The completed form can be shared with others, stored, imported to external apps, or transformed into any popular format.

You’ll never go wrong by using our web-based solution to execute 2010 Form 990 (Schedule R). Related Organizations And Unrelated Partnerships - Irs because it's:

- Effortless to set up and utilize, even for those who haven’t completed the documents online in the past.

- Robust enough to accommodate various modifying needs and form types.

- Safe and secure, making your editing experience safeguarded every time.

- Available across various operating systems, making it stress-free to complete the form from anywhere.

- Capable of creating forms based on ready-made templates.

- Friendly to numerous file formats: PDF, DOC, DOCX, PPT and JPEG etc.

Don't waste time editing your 2010 Form 990 (Schedule R). Related Organizations And Unrelated Partnerships - Irs obsolete way - with pen and paper. Use our full-featured tool instead. It gives you a versatile suite of editing options, built-in eSignature capabilities, and ease of use. What makes it differ from similar alternatives is the team collaboration capabilities - you can collaborate on forms with anyone, build a well-organized document approval workflow from A to Z, and a lot more. Try our online tool and get the best bang for your buck!

Related links form

Schedule A (Form 990) is used by an organization that files Form 990, Return of Organization Exempt From Income Tax, or Form 990-EZ, Short Form Return of Organization Exempt From Income Tax, to provide the required information about public charity status and public support.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.