Loading

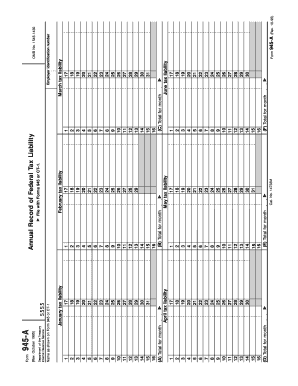

Get 1095 Form 945-a. Annual Record Of Federal Tax Liability

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1095 Form 945-A. Annual Record Of Federal Tax Liability online

The 1095 Form 945-A, also known as the Annual Record Of Federal Tax Liability, is a crucial document for reporting nonpayroll income tax withholding to the Internal Revenue Service. This guide aims to provide clear, step-by-step instructions on how to accurately fill out this form to ensure compliance with tax regulations.

Follow the steps to complete the 1095 Form 945-A online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Locate the section for 'Employer identification number' and enter your identifier as assigned by the IRS.

- In the Monthly Summary of Federal Tax Liability section, fill in the total tax liabilities for each month, from January to December. Refer to corresponding dates when payments were made.

- Make sure to add up the monthly totals (lines A through L) and enter the total tax liability for the year on line M. This figure should match line 4 on Form 945.

- If any adjustments are needed from previous returns, report these in the appropriate spaces for the corresponding dates and ensure they are correctly reflected in your current liabilities.

- Once all entries are completed, review the form for accuracy and ensure all necessary fields are filled.

- After confirming that all information is correct, you can save changes, download, print, or share the form as required.

Ensure your compliance and complete the necessary documents online.

If you don't have your 1095-A form, you may face challenges in completing your tax return, affecting your potential tax credits or penalties. In this case, it’s essential to take steps to retrieve it promptly. Using services like US Legal Forms can simplify the process of obtaining your 1095 Form 945-A. Annual Record Of Federal Tax Liability.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.