Loading

Get Form 940-ez - Irs

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 940-EZ - IRS online

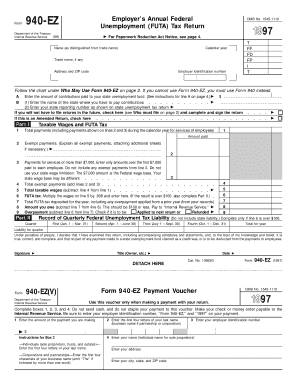

Filling out the Form 940-EZ is an essential task for employers to report their Federal Unemployment Tax Act (FUTA) tax. This guide provides step-by-step instructions to help users easily complete the form online, ensuring compliance with federal regulations.

Follow the steps to fill out the Form 940-EZ online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your name as distinguished from the trade name in the designated field. Make sure to also include your trade name, if applicable.

- Review the section titled 'Who May Use Form 940-EZ.' Confirm that you meet the criteria to use this simplified form.

- Proceed to Part I, where you will report taxable wages and FUTA tax. Start by entering the total payments made during the calendar year for your employees' services.

- Calculate your total taxable wages by subtracting the total exempt payments from your total payments. Enter this amount in line 5.

- Make sure to record the total FUTA tax deposited for the year in line 7 and calculate if any amount is owed or overpaid.

- Finally, sign and date your form to validate it. Review all information carefully before submission.

- After completing the form, you can save changes, download for your records, and print or share the completed form as needed.

Complete your Form 940-EZ online today to ensure timely compliance with federal tax requirements.

No, the 1040EZ form is no longer available as of the 2019 tax year. The IRS replaced it with the redesigned Form 1040, which accommodates a broader range of tax situations. If you need assistance with tax forms or want to learn more about your options, US Legal Forms can help you navigate these changes smoothly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.