Get Form 8883

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8883 online

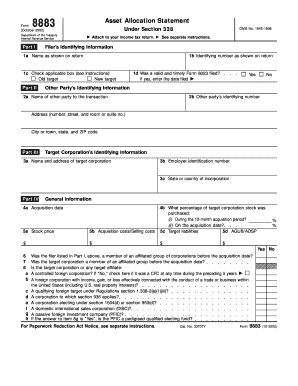

Filling out Form 8883 is essential for reporting the asset allocation statement under section 338 for your income tax return. This guide provides clear, step-by-step instructions for completing the form online, ensuring a smooth filing process.

Follow the steps to complete Form 8883 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In Part I, enter your name and identifying number as shown on your income tax return. Check the applicable box to indicate whether you are the old or new target.

- Complete Question 1d in Part II by indicating whether a valid and timely Form 8023 was filed. If yes, provide the date it was filed.

- In the Other Party’s Identifying Information section, fill in the name, identifying number, and address of the other party involved in the transaction.

- Part III requires you to provide the target corporation’s identifying information, including the name, address, and employer identification number.

- In Part IV, record the acquisition date, stock price, and acquisition/selling costs. Also, specify the percentage of target corporation stock purchased during the relevant periods.

- Answer questions related to the target corporation's affiliation and specific types of corporations in item 8 of Part IV, indicating 'Yes' or 'No' as applicable.

- In Part V, summarize the original statement of assets transferred, including aggregate fair market value and allocation amounts for each asset class.

- If necessary, complete Part VI for any supplemental statements regarding amendments to the original allocations. Provide the required details including the tax year and any changes.

- Review all entered information for accuracy. Once confirmed, save changes, download, print, or share the completed Form 8883 as needed.

Start filling out your Form 8883 online today to ensure your asset allocation reporting is accurate and timely.

Related links form

Form 8843 is used by certain non-resident aliens to explain their presence in the U.S. for tax purposes. If you are a student, teacher, or researcher spending time in the U.S., this form helps you maintain your non-resident status under U.S. tax law. It is often required even if you did not earn any income during your stay. Alongside Form 8883, it ensures that you fulfill your tax obligations correctly.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.