Get Irs Form 8881 2009

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Form 8881 2009 online

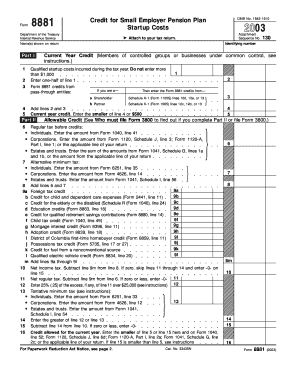

Filling out the IRS Form 8881 is essential for eligible small employers looking to claim a credit for qualified startup costs related to establishing or administering an eligible employer pension plan. This guide provides a clear and supportive process for completing the form online.

Follow the steps to fill out the IRS Form 8881 online effectively.

- Press the ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- Fill in the identifying number at the top of the form. This is typically your Employer Identification Number (EIN).

- In Part I, report the qualified startup costs you incurred during the tax year in line 1.

- For line 2, enter half of the amount reported on line 1.

- If you received credits from any pass-through entity, complete line 3 based on the information from Schedule K-1.

- In line 4, sum up the amounts from lines 2 and 3 to determine your current year credit amount.

- Complete Part II to determine your allowable credit based on your tax liabilities. Follow the specific instructions provided in this section.

- After filling out all relevant sections, review the form thoroughly for accuracy.

- Once you have completed the form and confirmed it is accurate, you can save changes, download, print, or share the form as needed.

Complete your documents online today to ensure you do not miss out on potential tax credits!

IRS Form 8881 is a tax form used to claim the federal tax credit for installing certain types of alternative energy systems, specifically solar energy systems or fuel cells. This form allows you to receive credits that can reduce your tax liability, providing financial relief and promoting sustainable energy practices. If you're considering investing in renewable energy, using the IRS Form 8881 2009 can significantly benefit your tax situation.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.