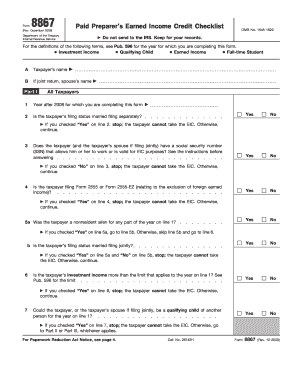

Get Form 8867 (rev. December 2009 ) - Irs - Irs

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8867 (Rev. December 2009) - IRS online

This guide provides comprehensive instructions on how to fill out the Form 8867, which is essential for taxpayers seeking the Earned Income Credit. By following the steps outlined below, users will be able to complete the form accurately and efficiently.

Follow the steps to successfully complete Form 8867

- Click 'Get Form' button to obtain the form and open it in your preferred format.

- Enter the taxpayer's name in box A and, if applicable, the spouse's name in box B if filing jointly.

- In Part I, answer question 1 by entering the year for which you are completing the form. Proceed to question 2 to determine if the taxpayer's filing status is 'married filing separately.' If 'Yes,' stop here as the taxpayer cannot take the EIC; otherwise, continue.

- Answer question 3 regarding the taxpayer's Social Security Number (SSN) eligibility. If 'No,' stop as they cannot take the EIC; continue if 'Yes.'

- For question 4, check if the taxpayer is filing Form 2555 or 2555-EZ. Stop if the answer is 'Yes,' otherwise proceed.

- Complete question 5a regarding nonresident alien status. If 'Yes' for 5a and 'No' for 5b, stop here; continue otherwise.

- Answer question 6 about investment income. If over the limit, stop; continue if under the limit.

- Question 7 checks if the taxpayer or spouse are a qualifying child of another person. If 'Yes,' stop; if 'No,' continue to Part II or Part III based on eligibility.

- If applicable, in Part II, fill out the child's name and confirm the child's relationship to the taxpayer in questions 8-12 referring to residency and age requirements.

- Complete questions regarding other possible qualifying children and comply with the necessary eligibility checks outlined in subsequent questions.

- For taxpayers without qualifying children, utilize Part III to provide details about residency and compliance with information gathering requirements.

- Ensure all required details are correct and adhere to documentation standards as specified throughout the form.

- Upon completion, save your changes, download the form, or print it for your records as necessary.

Complete your Form 8867 online today to ensure your eligibility for the Earned Income Credit.

A tax practitioner can satisfy the knowledge requirement on the Form 8867 (Rev. December 2009) - IRS - Irs by ensuring they have a clear understanding of the credit's eligibility criteria. This involves gathering and assessing relevant taxpayer information comprehensively. Additionally, ongoing education and training on tax laws enhance knowledge and compliance. Therefore, remaining informed is key to fulfilling this requirement effectively.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.