Get 1998 Form 8829. Expenses For Business Use Of Your Home - Irs

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1998 Form 8829. Expenses for business use of your home - IRS online

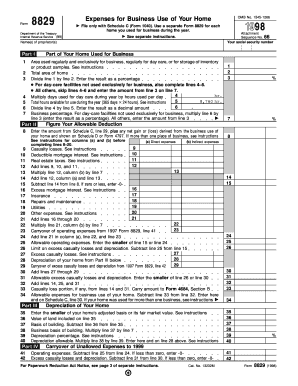

This guide provides a clear and comprehensive walkthrough for completing the 1998 Form 8829, essential for claiming expenses related to the business use of your home. By following these steps, users of all experience levels can accurately report their home business expenses to the IRS.

Follow the steps to effectively complete the form.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Enter the name(s) of proprietor(s) in the designated field at the top of the form.

- In Part I, input the amount from Schedule C, line 29, along with any net gain or loss from business use of your home as shown on Schedule D or Form 4797.

- Proceed to determine your home’s total area used for business. Enter both the area used regularly and exclusively for business and the total area of your home.

- Calculate the business percentage by dividing the area used for business by the total area.

- In Part II, complete sections outlining direct and indirect expenses related to the business use of your home, such as mortgage interest and real estate taxes.

- In Part III, calculate depreciation allowable based on your home’s adjusted basis. Make sure to follow the instructions carefully for accurate figures.

- Complete Part IV to summarize your total allowable expenses and any carryover of unallowed expenses to future years.

- After all sections are filled, review the form for accuracy. You can then save changes, download the completed form, print, or share it as needed.

Complete your documentation online today for accurate reporting.

To prove your home office is tax deductible, you must demonstrate that the space is exclusively used for business purposes. Keep detailed records, such as photos, utility bills, and a layout of your home, showing how the space is dedicated to business activities. The 1998 Form 8829, Expenses For Business Use Of Your Home - Irs, will assist you in documenting and justifying your claims. Additionally, consider using platforms like uslegalforms to ensure you meet all IRS requirements adequately.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.