Loading

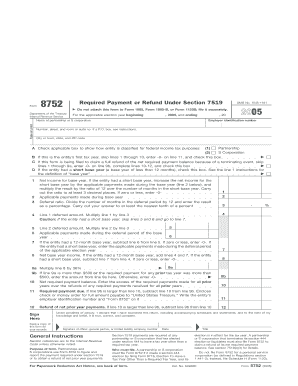

Get 2005 Form 8752. Required Payment Or Refund Under Section 7519 - Irs

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2005 Form 8752. Required Payment or Refund Under Section 7519 - IRS online

Filling out the 2005 Form 8752 is essential for partnerships and S corporations that have made an election under section 444 to report required payments or claim refunds. This guide provides clear, step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to complete the form successfully.

- Click ‘Get Form’ button to obtain the form and open it for editing. Ensure you have it readily accessible for completion.

- Enter the beginning and ending dates of your applicable election year in the designated fields. It is crucial to specify the year correctly.

- Provide the name of the partnership or S corporation and its employer identification number. Include the complete address details including street number, city or town, state, and ZIP code.

- Indicate the entity’s classification by checking the appropriate box for partnership or S corporation.

- If this is the entity’s first tax year, check the corresponding box and skip lines 1 through 10, entering -0- on line 11.

- If the form is being filed for a full refund due to a terminating event, check the respective box and complete lines 10-12.

- For line 1, report the net income for the base year as per the guidelines, ensuring it is not less than zero.

- In line 2, indicate the applicable payments made during the base year.

- Calculate the deferral ratio for line 3 by dividing the number of months in the deferral period by 12.

- Complete line 4 by multiplying the net income by the deferral ratio.

- On line 10, enter the required payment due. If there is a balance due, submit a check or money order to the United States Treasury.

- Finally, ensure to sign and date the form in the signature section, declaring under penalties of perjury that the return is true and correct.

- Once completed, save any changes, and download or print the form for your records.

Complete your documents online to stay compliant and well-organized.

To obtain your offset bypass refund, you must ensure that you meet specific criteria set by the IRS. If you filed a 2005 Form 8752 and received an offset, you can request a bypass. Utilizing services like UsLegalForms can streamline this process, providing guidance and documentation to help you recover your funds efficiently.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.