Loading

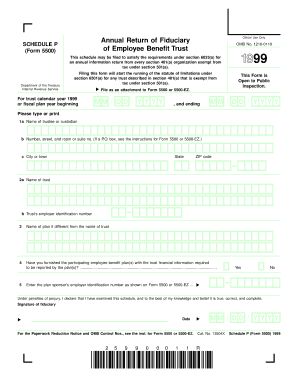

Get 1999 Form 5500 Schedule P. Annual Return Of Fiduciary Of Employee Benefit Trust - Irs

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1999 Form 5500 Schedule P. Annual Return of Fiduciary of Employee Benefit Trust - IRS online

Navigating the completion of the 1999 Form 5500 Schedule P can seem daunting, but this guide provides clear instructions to simplify the process. Whether you are familiar with tax forms or seeking guidance for the first time, follow these steps to ensure you complete the form accurately and efficiently.

Follow the steps to complete the online form with ease.

- Press the ‘Get Form’ button to access the form and open it in your editing environment.

- In Section 1a, enter the name of the trustee or custodian responsible for the trust. Ensure the name is accurate as it is critical for identification purposes.

- Complete Section 1c by specifying the city or town, along with the state and ZIP code for the trust's address.

- In Section 2a, enter the official name of the trust, and in Section 2b, include the trust's employer identification number (EIN). If the plan name differs from the trust name, list the plan name here as well.

- For Section 4, indicate whether you have provided the necessary financial information to the participating employee benefit plan(s). Select 'Yes' or 'No' accordingly.

- In Section 5, input the plan sponsor's employer identification number as it appears on Form 5500 or 5500-EZ.

- Before finalizing the form, review Section 3 and sign, verifying that the information provided is true, correct, and complete. Enter the date of signing. This declaration is crucial as it affirms your commitment to the accuracy of the submission.

- Once all fields are completed, you can choose to save your progress, download the form for offline access, print a hard copy, or share it as required.

Complete your 1999 Form 5500 Schedule P online today to ensure timely compliance with IRS regulations.

File online using EFAST2's web-based filing system or • File through an EFAST2-approved vendor. Detailed information on electronic filing is available on the EFAST2 website at .efast.dol.gov. If you have questions and need help in completing this form, please call the IRS Help Desk at 877-829-5500.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.