Loading

Get Form 4684

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 4684 online

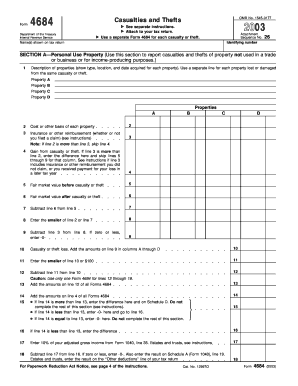

Form 4684 is used to report casualties and thefts for personal or business property. This guide will provide you with a clear, step-by-step approach to completing the form online, ensuring that you understand each component and how to accurately report your losses.

Follow the steps to complete Form 4684 online effectively.

- Press the ‘Get Form’ button to acquire the form, which will open in your designated form editor.

- Begin with Section A for Personal Use Property. Here, describe each property that has been affected by a casualty or theft, providing details such as the type of property, its location, and the date you acquired it. Use a new line for each property.

- Next, indicate the cost or other basis of each property. This is crucial for determining your loss.

- List any insurance or other reimbursements received for your losses. This includes amounts whether or not you filed a claim.

- Calculate and enter the gain from the casualty or theft if applicable, using the formula provided in the form instructions.

- Proceed to enter the fair market value before and after the casualty or theft, which will help you assess the extent of the loss.

- Finalize your calculation by determining the casualty or theft loss, summarizing the amounts across the various columns (A through D).

- Complete the necessary additional calculations on lines 11 through 18, as required, to determine the final loss for your tax return.

- For businesses or income-producing properties, switch to Section B, and repeat similar steps for reporting gains and losses related to these properties.

- Once all sections are completed, review your entries for accuracy. You can save changes, download, print, or share the completed form as needed.

Start filling out your documents online today to ensure your financial records are accurate and up to date.

To figure out your casualty loss deduction, first calculate the decrease in value of your property due to the casualty event. You then need to subtract any insurance payments you received to determine your deductible loss. Use Form 4684 to report these figures accurately. This way, you ensure you receive the maximum deductible amount on your tax return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.