Loading

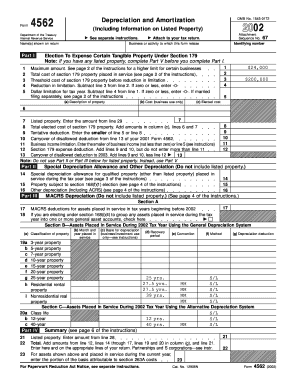

Get 2002 Form 4562. Depreciation And Amortization - Irs

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2002 Form 4562. Depreciation And Amortization - Irs online

This guide provides detailed instructions on how to effectively complete the 2002 Form 4562, which is essential for reporting depreciation and amortization of assets on your tax return. Whether you are familiar with tax forms or not, this step-by-step approach will assist you in navigating the form with confidence.

Follow the steps to accurately complete the form.

- Press the ‘Get Form’ button to obtain the form and access it in the online editor.

- Enter the name(s) shown on your return in the designated field at the top of the form. Ensure the names are written exactly as they appear on your tax return.

- Complete lines to detail the total cost, threshold cost before limitation, and any reduction in limitation. Be sure to apply the correct business use of the property and calculate the elected cost accurately.

- Proceed to Special Depreciation Allowance and Other Depreciation in Part II. Here, input the special depreciation allowance for qualified property and any other depreciation details required.

- In Part III, enter the MACRS depreciation information, ensuring to specify the classification of property and the respective details about the month and year placed in service, as well as the recovery period.

- Review Part IV for any assets that may be claimed under Section 263A costs. Ensure all entries reflect the summary of deductions accurately.

- If applicable, complete Part V for listed property. Provide information such as type of property, dates placed in service, business use percentage, and any depreciation deduction claimed.

- Lastly, fill out Part VI regarding amortization. This includes detailing the description of costs, the date amortization begins, and the amortizable amount.

- After completing all sections, review your entries for accuracy. Save your changes, and choose to download, print, or share the form as needed.

Complete your forms online efficiently to meet your deadlines and ensure compliance.

Yes, when you continue to claim depreciation on your rental property, filing the 2002 Form 4562 each year is necessary. This form helps maintain consistency and accuracy in reporting your property’s depreciation. Staying compliant with this requirement ensures you don’t miss out on potential tax benefits.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.