Loading

Get 1998 Form 1116 Irs

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1998 Form 1116 Irs online

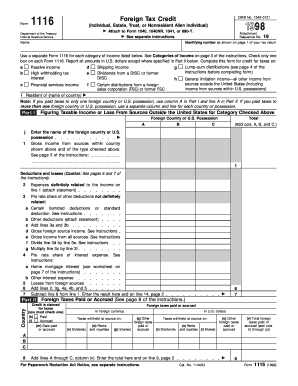

Filling out the 1998 Form 1116 is an essential step for individuals seeking a foreign tax credit. This guide provides a clear, step-by-step approach to help users complete the form accurately and efficiently online.

Follow the steps to complete the 1998 Form 1116 Irs online.

- Press the ‘Get Form’ button to access the form and open it in your preferred format.

- Begin by entering your name and identifying number as shown on your tax return in the designated fields.

- Select the appropriate category of income for which you are claiming the foreign tax credit. Ensure you use a separate Form 1116 for each income category.

- In Part I, list the foreign country or U.S. possession where the taxes were paid. Enter gross income from sources within that country.

- Input deductions and losses related to the income listed, making sure to provide supporting statements as necessary.

- Complete the sections for foreign taxes paid or accrued in Part II. Indicate whether the taxes were paid or accrued and provide dates.

- Calculate the total foreign taxes paid or accrued and enter the amount in the designated line.

- In Part III, figure the credit by entering the total foreign taxes and carryover information as instructed.

- Complete the summary of credits in Part IV, ensuring you add all relevant amounts from previous sections.

- After filling out all sections and verifying accuracy, save your changes, download the completed form, or print it for your records.

Start filling out your 1998 Form 1116 online today!

To claim a foreign tax exemption, you should first check if your income falls under any treaty provisions between the U.S. and the foreign country. If applicable, you can use the 1998 Form 1116 IRS to report your foreign tax credits and claim any exemptions. It's vital to provide accurate information and documentation to support your claim. For a smoother process, consider consulting with USLegalForms to ensure you follow all required steps.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.