Get Form 1066 - Irs - Irs

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Form 1066 - IRS - Irs online

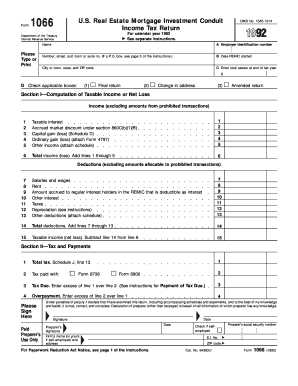

Filling out Form 1066, the U.S. Real Estate Mortgage Investment Conduit Income Tax Return, can be a vital task for those managing real estate and mortgage-related investments. This guide will walk you through the step-by-step process of completing this form online, ensuring clarity and accuracy in your filing.

Follow the steps to complete Form 1066 accurately.

- Click ‘Get Form’ button to obtain the form and open it in the appropriate editor.

- Begin by filling out the identifying information at the top of the form including the name, employer identification number, address, and the date the REMIC started.

- Next, report your total assets at the end of the tax year in section C.

- Check any applicable boxes in section D for final return, change of address, or amended return.

- Proceed to Section I, where you will list your income sources such as taxable interest, accrued market discount, capital gains, and ordinary gains. Add these amounts at line 6 to calculate your total income.

- In the deductions section, enter allowable expenses like salaries, rent, interest accrued, taxes, and depreciation. Sum these in line 14 to determine total deductions.

- Calculate your taxable income or net loss by subtracting total deductions from total income; enter this amount in line 15.

- Switch to Section II to compute taxes and payments. Fill out the total tax owed and any tax payments made during the year.

- If applicable, calculate any overpayment or tax due by following the instructions provided in the form.

- Finally, review your completed form, save your changes, and choose to download, print, or share it as necessary.

Start completing your Form 1066 online today for accurate and efficient filing.

To file a 1099 step by step, start by gathering all relevant payment information for contractors. Next, download the appropriate 1099 form from the IRS website or a legal document platform like UsLegalForms. Fill out the form accurately, report the payments, and ensure you meet the deadline for submission. Finally, send a copy to both the IRS and the recipient, ensuring you comply with all filing requirements.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.