Loading

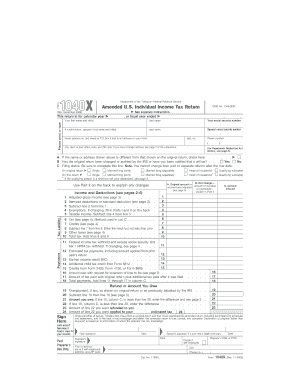

Get November 2004) 1040x Your First Name And Initial Form Department Of The Treasury--internal Revenue

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the November 2004 1040X Your First Name And Initial Form Department Of The Treasury–Internal Revenue online

Filling out the November 2004 1040X form is a crucial step for individuals looking to amend their previously filed U.S. individual income tax return. This guide provides a clear and supportive approach to help you navigate the form online effectively.

Follow the steps to complete your amended return accurately.

- Click the ‘Get Form’ button to access the form and open it in your preferred editor.

- Begin by filling out your personal information at the top of the form, including your first name, last name, social security number, and address. If applicable, include your spouse’s information as well.

- Review the box that indicates if your name or address has changed from the original return. Check ‘Yes’ if applicable.

- Indicate whether the original return has been changed or audited by the IRS by checking the appropriate box.

- Select your filing status on the form. Ensure it aligns with your original return, as you cannot change from a joint to separate return after the due date.

- Proceed to calculate your income and deductions. Fill in the amounts for adjusted gross income and itemized or standard deductions as applicable, ensuring accuracy.

- Fill out the tax liability section, inputting the necessary figures as required. This includes federal income tax withheld and any applicable credits.

- Complete the payments section, detailing any overpayments or amounts owed based on your amendments.

- Use Part II on the back of the form to provide explanations for any changes you are making, ensuring to attach any relevant documentation.

- Finally, sign and date the form. If filing jointly, ensure both parties sign. Review to ensure all fields are filled accurately before submission.

- Once completed, you can save your changes, download the form, print it for your records, or share it as needed.

Take action now to amend your returns online and ensure your tax documents are accurate.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Essentially, the 1040X amended return is a correction tool that allows taxpayers to adjust their previously submitted tax returns. This amendment can address mistakes, enhance information accuracy, or claim overlooked credits. It’s a key component of maintaining compliance with the November 2004) 1040X Your First Name And Initial Form Department Of The Treasury--Internal Revenue process.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.