Get F1040sc

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the F1040sc online

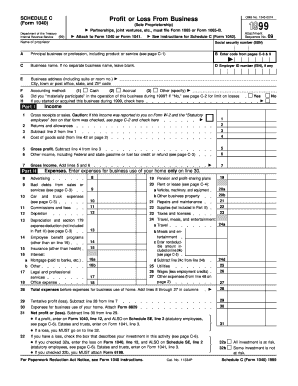

Filling out the F1040sc, also known as the Schedule C, is an essential process for reporting profit or loss from a business you operated as a sole proprietorship. This guide will provide clear and supportive instructions to help you navigate each section of the form effectively.

Follow the steps to successfully complete the F1040sc online.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Enter your name as the proprietor in the designated field, followed by your social security number (SSN).

- In the principal business or profession field, describe the type of business you engaged in, specifying products or services offered.

- Locate the accounting method section and select your accounting method, choosing from cash, accrual, or other, as applicable.

- If applicable, indicate whether you materially participated in the business operation during the specified tax year.

- Complete Part I by detailing your gross receipts or sales and deduct necessary expenses to calculate your net profit or loss. Carefully fill in lines regarding income, expenses, and any other relevant fields.

- Proceed to Part II if you need to report any losses and check the appropriate box related to your investment risk in the business activity.

- For Part III, provide information on business inventory, detailing how you value inventory and any changes in accounting for inventory values.

- If you are claiming vehicle expenses, complete Part IV by providing details about your vehicle's use and relevant business mileage.

- Document any other business expenses in Part V that have not been included in previous sections.

- Review all entries for accuracy before saving changes, and then download, print, or share the completed form as needed.

Take the next step and complete your documents online today!

Reporting a Schedule C loss can raise eyebrows at the IRS, especially if it occurs repeatedly. While losses are a normal part of business, consistently showing them may lead to questions about your business validity. To protect yourself, document your business activities and financial statements clearly. The F1040sc can help you present your situation confidently, showcasing your business's narrative alongside its numbers.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.