Loading

Get Form 8813

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8813 online

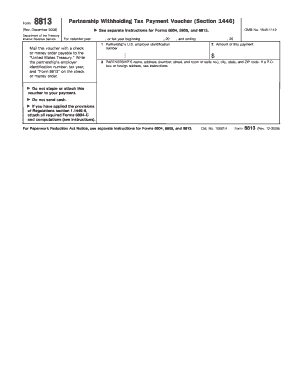

Form 8813 is the Partnership Withholding Tax Payment Voucher used for tax payments associated with partnerships. This guide will provide you with a step-by-step process to complete the form online, ensuring a smooth and compliant submission.

Follow the steps to complete Form 8813 efficiently.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the partnership's U.S. employer identification number in the designated field labeled 'Partnership's U.S. employer identification number.' This number is essential for tax identification and must be accurate.

- Next, input the total amount of the payment being made into the 'Amount of this payment' field. Ensure this reflects the correct amount to avoid any issues with the payment.

- Fill in the partnership’s name, complete address (including street number and suite number if applicable), city, state, and ZIP code in the section provided. If using a P.O. box or a foreign address, follow the specific instructions provided for these cases.

- Review all entries for accuracy and completeness. Double-check the employer identification number, payment amount, and address details to prevent any delays or discrepancies.

- Once all fields are filled out correctly, save your changes. You may then choose to download the form or print it out for mailing. Remember to send the voucher with a check or money order payable to the 'United States Treasury.'

- Make sure to write the partnership’s employer identification number, tax year, and 'Form 8813' on the check or money order. Do not staple or attach the voucher to your payment, and do not send cash.

Complete your Form 8813 online today for a hassle-free tax payment experience.

To file taxes for a partnership LLC, you will complete Form 1065, which reports the income, deductions, gains, and losses of the partnership. Additionally, partners often need to fill out Schedule K-1 to report their individual shares. It is important to use Form 8813 as part of your filing process to ensure compliance. Using a reliable platform like US Legal Forms can help streamline this process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.