Get Form 8867

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8867 online

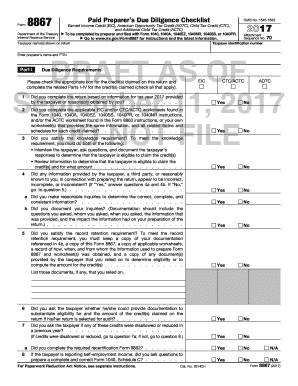

Filling out Form 8867, the Paid Preparer's Due Diligence Checklist, is essential for tax preparers who assist clients in claiming certain credits. This guide provides straightforward, step-by-step instructions for completing this form online, ensuring compliance and accuracy.

Follow the steps to successfully complete Form 8867 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the taxpayer identification number and names as shown on the tax return in the designated fields.

- Fill in the preparer’s name and PTIN (Preparer Tax Identification Number) as required.

- In Part I, check the appropriate box for each credit claimed: Earned Income Credit (EIC), Child Tax Credit (CTC), or Additional Child Tax Credit (ACTC) and indicate whether you completed the required worksheets.

- Address the knowledge requirement by documenting your interview with the taxpayer to ascertain eligibility for each credit.

- Review provided information for inconsistencies and make inquiries if necessary, documenting any discrepancies encountered.

- Ensure that you follow the record retention requirement by keeping copies of necessary documentation as described in the form.

- Complete due diligence questions specific to EIC, CTC, or ACTC in the relevant parts of the form, ensuring to ask about past disallowed claims if applicable.

- Once all sections are filled out accurately, review the information for correctness before finalizing.

- After completing the form, you can save changes, download, print, or share the form as needed.

Start completing your Form 8867 online today to ensure compliance and support your clients effectively.

To satisfy the knowledge requirement of Form 8867, a tax practitioner must obtain sufficient information about the client's circumstances and the relevant tax law. This often involves asking detailed questions and verifying facts through supporting documents. Using platforms like uslegalforms can provide additional resources and guidance to ensure that practitioners fulfill these knowledge requirements effectively.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.