Get 6251

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 6251 online

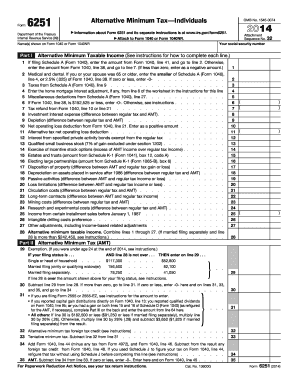

Filling out Form 6251, the alternative minimum tax for individuals, is an important part of completing your tax return. This guide will provide you with clear, step-by-step instructions to ensure you fill out the form accurately and efficiently.

Follow the steps to complete Form 6251 smoothly.

- Click the ‘Get Form’ button to obtain the form and access it in the designated editor.

- Fill in your social security number and the name(s) as shown on Form 1040 or Form 1040NR at the top of the form.

- Part I requires entering alternative minimum taxable income. If you filed Schedule A, use Form 1040 line 41; if not, use line 38. Proceed to line 2 from there.

- Line 2 asks for medical and dental expenses. Enter the smaller of Schedule A line 4 or 2.5% of Form 1040 line 38.

- Continue to fill in the required amounts for lines 3 through 27 as prompted. Mostly from Schedule A and any adjustments you need to include.

- In line 28, combine all the amounts from lines 1 through 27 to determine your alternative minimum taxable income.

- In Part II, check your filing status and refer to the appropriate maximum income exemption amount on line 29.

- Complete lines 30 through 35 by performing the necessary calculations based on your entries from Part I.

- If applicable, fill out Part III based on capital gains rates, following the instruction prompts of lines 36 through 64.

- After completing the form, save your changes, and choose to download, print, or share the filled-out Form 6251 as needed.

Start filling out your Form 6251 online today for a smooth tax filing process.

You need to fill out form 6251 if your income exceeds certain thresholds that require you to calculate alternative minimum tax. Factors like high income, significant deductions, or specific tax credits may trigger this requirement. To ensure compliance, use the IRS guidelines or consider resources like uslegalforms which can provide insights on handling form 6251 appropriately. Assess your situation carefully to determine necessity.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.