Loading

Get 2014 Form 8815

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2014 Form 8815 online

Filling out Form 8815 online can be a straightforward process if you follow the right steps. This guide provides you with a clear and supportive overview to help you accurately complete the form, ensuring all necessary information is included.

Follow the steps to successfully complete the form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor. This will allow you to start filling out the necessary fields.

- Enter the calendar or fiscal plan year in section A. Ensure that you correctly specify the timeframe for your filing.

- Fill in the plan sponsor's name in section C by referring to line 2a of Form 5500. This identifies the organization responsible for the plan.

- Input the three-digit plan number (PN) and the Employer Identification Number (EIN) in the respective sections of the form. These identifiers are crucial for the proper processing of your form.

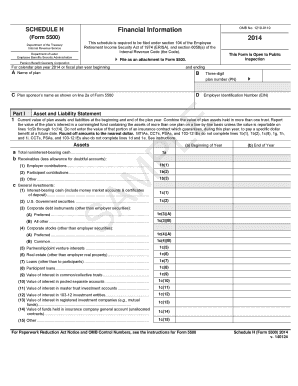

- Complete Part I by providing the current value of plan assets and liabilities at the beginning and end of the plan year. Follow the instructions for rounding amounts to the nearest dollar.

- Proceed to fill out Part II, which includes the income and expense statement. Record all income and expenses related to the plan meticulously, ensuring you include all applicable contributions and earnings.

- In Part III, if applicable, provide the opinion of an independent qualified public accountant. This part may not be necessary for all users, so consult the instructions carefully.

- Address the compliance questions in Part IV. These questions are essential for ensuring that the plan complies with regulations.

- Once all sections are filled out, review the form for accuracy and completeness. Make any necessary adjustments.

- Finally, save changes, download the form, or print it to ensure you have a copy for your records. You may also need to share the form as required.

Complete your forms online to ensure a smooth filing process.

Related links form

The value of a $10,000 savings bond after 30 years can vary based on the bond's interest rate and redemption terms. Generally, you can expect the bond to be worth significantly more than its face value due to compound interest. To determine the exact amount, refer to the U.S. Treasury's savings bond calculators or inquire about current rates. Understanding these values can keep you informed about your investments.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.