Loading

Get Ia 706

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ia 706 online

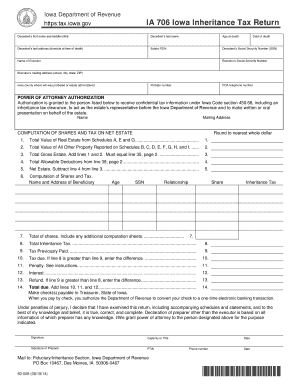

The Ia 706 form is essential for reporting Iowa inheritance tax, ensuring compliance with state regulations. This guide will help you navigate the process of completing the form accurately and efficiently, even if you have limited legal experience.

Follow the steps to complete your Ia 706 form online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- Fill out the decedent's information, including their first name, last name, age at death, last address, and Social Security Number (SSN). Ensure to enter accurate details to avoid any compliance issues.

- Enter the estate's Federal Employer Identification Number (FEIN) and the date of death. This information is crucial for identifying the estate and processing the inheritance tax.

- Provide the executor's information, including their name, SSN, mailing address, and contact number. The executor handles the estate administration, so accurate details are important.

- Designate the Iowa county where the will was probated or the estate administered, and include the probate number.

- Complete the Power of Attorney section by listing the authorized representative's details to handle confidential tax information for the estate.

- Proceed to the Computation of Shares and Tax sections. Document the total value of real estate and all other property as reported on the respective schedules. Ensure the totals align.

- Calculate the total gross estate, allowable deductions, and net estate. Ensure to round values to the nearest whole dollar as required.

- Document the computation details for each beneficiary, including their relationship and share of the estate. Accurate record-keeping is essential for clarity.

- Review all figures for accuracy, including tax previously paid, penalties, interest, and any refund amounts, before finalizing your form.

- Sign the declaration at the bottom stating that the information provided is true and correct, including your capacity or title and date.

- After completing the form, you can save your changes, download, print, or share the Ia 706 as needed for submission.

Ensure your estate’s compliance by completing the Ia 706 online today.

One effective way to leave your estate to your children is to utilize trusts that specify asset distribution while minimizing tax implications. Planning ahead allows for smoother transitions and can ensure your intentions are honored. Engaging with tools that address Ia 706 can help you establish a solid plan for your estate.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.