Get Form 05 166 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 05 166 2017 online

Filling out the Form 05 166 2017 online can seem daunting, but this guide will walk you through each step in a clear and supportive manner. We aim to provide you with detailed instructions that make the process easier for everyone, regardless of their familiarity with such forms.

Follow the steps to complete the form online effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

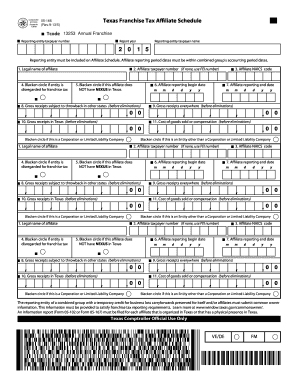

- In the field for ‘Reporting entity taxpayer number’, enter your assigned taxpayer identification number.

- Fill in the ‘Report year’ by selecting the appropriate year for your report.

- Input the ‘Reporting entity taxpayer name’ in the designated area.

- For the ‘Legal name of affiliate’, provide the official name of the affiliate.

- In the next section, enter the ‘Affiliate taxpayer number’. If this is unavailable, use the Federal Employer Identification Number (FEI).

- Select the appropriate options by blackening the circle if the entity is disregarded for franchise tax.

- Indicate whether this affiliate does NOT have NEXUS in Texas by blackening the corresponding circle.

- Complete the fields for ‘Gross receipts subject to throwback in other states’, ‘Gross receipts everywhere’, and ‘Gross receipts in Texas’, ensuring the figures are accurate.

- Enter the ‘Cost of goods sold or compensation’ before eliminations.

- Specify the ‘Affiliate reporting begin date’ and ‘end date’ in the given format.

- If applicable, indicate the entity type by blackening the appropriate circles for Corporation or Limited Liability Company.

- Review all entries for accuracy, and then save your changes. You can download, print, or share the form as needed.

Complete your Form 05 166 2017 online today for a seamless submission process.

For 2025, the Texas franchise tax no tax due threshold indicates that if your business revenue falls below a specific limit, you will not owe any franchise tax. However, you are still required to file the annual report to confirm your revenue status. This process helps maintain transparency with the state. As part of this, ensure you include Form 05 166 2017 in your filings to keep everything organized.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.