Loading

Get Form 720 (rev. April 2014) - Irs

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 720 (Rev. April 2014) - IRS online

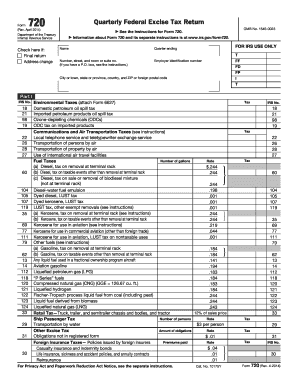

Form 720, the Quarterly Federal Excise Tax Return, is essential for reporting various excise taxes owed to the IRS. This guide provides a clear, step-by-step approach to completing the form online, ensuring users are well-informed throughout the process.

Follow the steps to effectively complete your IRS Form 720 online.

- Click ‘Get Form’ button to obtain the form and open it in an online editor.

- Fill in your name, address, and employer identification number (EIN) in the appropriate fields. Ensure that the information is accurate as it must match IRS records.

- Indicate the quarter ending date for which you are filing this return. This helps to assign your reported taxes to the correct filing period.

- Complete Part I by entering amounts related to various excise taxes. This includes environmental taxes, communication taxes, and fuel taxes. Be thorough and refer to instructions for tax rates applicable to your specific items.

- Move to Part II, where you will report the Patient-Centered Outcomes Research Fee, if applicable. Fill in the average number of lives covered and the corresponding fee.

- Proceed to Part III to calculate your total tax. Add amounts reported in Parts I and II to determine your overall liability.

- If there are any claims or overpayments from previous quarters, complete Schedule C for claims and report them in the specified section in Part III.

- Review the information filled out to ensure completeness and accuracy. Rectifying errors before submission can prevent complications later.

- Once you have filled out and reviewed the form, you can save the changes. Then you may choose to download, print, or share the completed form as required.

Complete your IRS Form 720 online today to ensure timely and accurate filing.

To contact the IRS regarding Form 720, you can reach out via their official website or by calling their support line directly. Their representatives can provide guidance on how to file or inquire about Form 720 (Rev. April 2014) - IRS. Additionally, using UsLegalForms can equip you with the information and resources needed to effectively communicate with the IRS.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.