Loading

Get Scdor 111

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Scdor 111 online

Filling out the Scdor 111 form is an essential step for individuals and businesses registering for various tax purposes in South Carolina. This guide will provide you with clear instructions to complete the form accurately and efficiently.

Follow the steps to successfully complete the Scdor 111 form.

- Click ‘Get Form’ button to obtain the Scdor 111 form and open it in the appropriate editor.

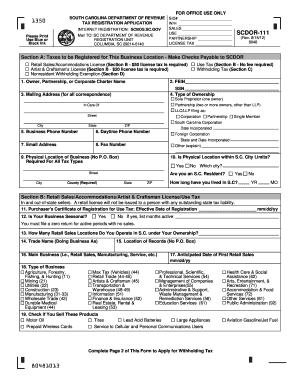

- Begin by reviewing Section A, where you will select the taxes you need to register for this business location. Check the relevant boxes for retail sales, use tax, and withholding tax as applicable.

- Fill out your business ownership details. In field 1, enter the name of the owner, partnership, or corporate entity. Field 2 requires the Federal Employer Identification Number (FEIN). Complete the mailing address in field 3, ensuring to include the street address, city, state, and ZIP code.

- Indicate your business phone number, daytime phone number, and email address in fields 5, 6, and 7 respectively. Field 8 is for your fax number, if applicable.

- In field 10, answer whether the physical location is within South Carolina city limits and clarify the city in case of a 'No' response.

- Complete Section B by addressing questions concerning retail sales or accommodations. Specify if your business is seasonal in field 12 and list active months if applicable.

- Continue to fill out the remaining fields, including the anticipated date of first retail sales and information about your business type and trade name.

- In Section C for withholding tax, check the applicable box for your business type and indicate the filing frequency that applies to you.

- Finish Section D by checking the appropriate block to register for nonresident withholding exemption if it applies.

- In Section E, list the name, home address, and percentage of ownership for each business owner or partner. Make sure to include their social security number, as required.

- After reviewing all information for accuracy, sign and date the application. The signature must be from the owner, all partners, or corporate officers.

- Once completed, save your changes. You can then download, print, or share the form as needed.

Complete your Scdor 111 form online today to ensure your business is registered correctly.

Filling out a tax form begins with selecting the right one for your situation, such as the SCDOR 111 for South Carolina filers. Gather your income statements, list deductions, and follow the instructions precisely. If you need assistance, consider platforms like USLegalForms that provide step-by-step guidance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.