Get Fha Rate And Term Refinance Worksheet

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FHA Rate And Term Refinance Worksheet online

This guide provides step-by-step instructions on how to accurately complete the FHA Rate And Term Refinance Worksheet online. By following these instructions, users will be able to ensure that all necessary information is properly submitted for refinancing purposes.

Follow the steps to fill out the FHA Rate And Term Refinance Worksheet online.

- Click ‘Get Form’ button to obtain the worksheet and open it in your preferred editor.

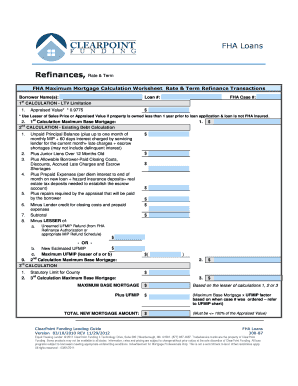

- Begin entering the Borrower Name(s) and Loan Number at the top of the worksheet. This step is essential for identifying the loan application.

- Locate the ‘FHA Case #’ field and input the assigned case number for your FHA loan, which is crucial for processing.

- In the ‘Calculation - LTV Limitation’ section, input the appraised value of the property adjusted by 0.9775 to calculate the limit.

- Proceed to the ‘Existing Debt Calculation’ section. Here, list the unpaid principal balance, including any applicable monthly mortgage insurance premium (MIP) and additional fees.

- Continue detailing any junior liens over 12 months old, allowable borrower-paid closing costs, prepaid expenses, and repairs needed as per appraisal.

- Subtract any lender credits for closing costs and prepaid expenses from the subtotal to arrive at the next figure.

- Conduct the lesser of calculations for unearned UFMIP refund and new estimated UFMIP to finalize the closing costs.

- In the ‘Statutory Limit for County’ section, make sure to provide accurate information pertaining to the property’s location.

- Summarize the final calculations to determine the total new mortgage amount, ensuring it does not exceed 100% of the appraised value.

- After completing all fields, review the information for accuracy before saving changes, downloading, printing, or sharing the completed worksheet.

Complete your FHA Rate And Term Refinance Worksheet online today to streamline your refinancing process.

Related links form

The 2% rule indicates that a homeowner should consider refinancing if they can obtain a lower interest rate that is at least 2% lower than their current rate. This guideline helps ensure that the benefits of refinancing outweigh the costs involved. If you meet this criteria, significant savings could come your way. The Fha Rate And Term Refinance Worksheet can help you assess if you qualify for this rule.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.