Loading

Get Unitus Refi Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Unitus Refi Form online

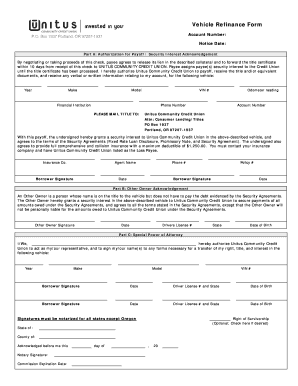

Completing the Unitus Refi Form online is a straightforward process designed to facilitate your vehicle refinancing needs. This guide provides step-by-step instructions to ensure you fill out the form accurately and efficiently.

Follow the steps to complete the Unitus Refi Form online.

- Click ‘Get Form’ button to obtain the Unitus Refi Form and open it for editing.

- Enter your account number in the designated field at the top of the form. This helps identify your account with the credit union.

- Fill in the notice date in the specified area to indicate when you are submitting the form.

- In Part A, provide the authorization for payoff and security interest acknowledgment. Make sure to include the vehicle details such as year, make, model, VIN, financial institution, and odometer reading.

- List your contact information, including your phone number, and the address where you want the title mailed. This is usually directed to Unitus Community Credit Union.

- Acknowledge your agreement to provide full comprehensive and collision insurance by entering your insurance company name, agent's name, and policy number.

- Sign and date the form where indicated. If there are co-borrowers, ensure that they also provide their signatures.

- In Part B, if applicable, the other owner must sign to acknowledge their agreement to the security interest without being liable for the debt.

- In Part C, if you wish to authorize a special power of attorney, complete the necessary details and signatures. Verification may be required depending on state regulations.

- Once all sections are completed, review your entries for accuracy, save changes, and choose to download, print, or share the completed form as needed.

Complete your Unitus Refi Form online today for a seamless refinancing experience.

Starting the refinancing process begins with assessing your current mortgage and your reasons for refinancing. You should gather your financial information, including your income and credit details. From there, complete the Unitus Refi Form to explore your refinancing options. This form streamlines the process, making it easier for you to determine the best path forward.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.