Loading

Get Form 1063 Irs

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 1063 IRS online

Filling out the Form 1063 IRS online may seem daunting, but with clear guidance, you can navigate the process confidently. This guide will provide you with step-by-step instructions to complete the form accurately.

Follow the steps to complete Form 1063 IRS online.

- Press the ‘Get Form’ button to access the form and open it in your web browser.

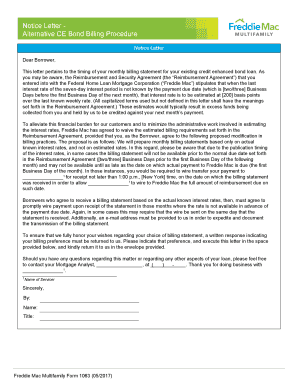

- Begin by entering your loan information. Include the Loan Name and Loan Number as requested in the designated fields.

- Select your billing preference by checking the box next to either 'Actual Interest' or 'Estimated Interest'. Review the descriptions provided to understand the implications of each choice.

- If you opt for 'Actual Interest,' acknowledge that you may receive billing statements later than usual and understand the requirement to wire payment promptly.

- If you choose 'Estimated Interest,' review the terms, confirming your understanding of how interest rates are calculated and excess funds managed.

- Fill in your email address in the provided field where billing statements should be sent. Ensure this information is correct to avoid delays.

- Sign and date the form in the designated areas to indicate your agreement with the billing preferences outlined.

- After completing all sections of the form, save any changes made. You can then download, print, or share the form as necessary.

Complete your documents online today for a streamlined experience.

IRS Form 1065 is utilized to report the financial activity of partnerships to the IRS. It allows the partnership to declare income, gains, losses, and deductions, which are then passed onto partners. If you're considering filing this alongside Form 1063 IRS, UsLegalForms can assist you in the process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.