Get Phfa Form 3

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Phfa Form 3 online

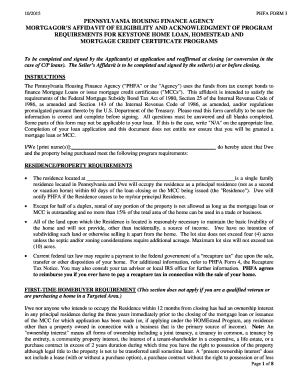

Filling out the Phfa Form 3 online is a critical step in applying for various housing finance programs supported by the Pennsylvania Housing Finance Agency. This guide will assist you in understanding and completing the form efficiently and accurately.

Follow the steps to complete the Phfa Form 3 online effectively.

- Click the ‘Get Form’ button to retrieve the form and open it in your editor.

- Begin by entering your name in the designated field, ensuring it is printed clearly as all applicants must attest to their eligibility.

- In the residence/property requirements section, provide the address of the property you intend to purchase, confirming that it will be your principal residence.

- Answer questions regarding rental restrictions and land use. If certain conditions do not apply to you, indicate 'N/A' in the relevant fields.

- Complete the first-time homebuyer requirement section if applicable. Provide details about previous homeownership to affirm your eligibility.

- Fill out the income information section. Ensure that you list all sources of income for every adult household member, including dependent students.

- Calculate your total acquisition cost following the guidelines in the form. Provide itemized amounts where needed and confirm they meet PHFA limits.

- Review the new mortgage requirement section. Confirm that proceeds from your mortgage loan will not be used to repay existing loans inappropriately.

- Authorize PHFA to verify your provided information. This includes past income and asset verifications necessary to support your application.

- Upon completion, review the form thoroughly for accuracy. Once satisfied, save the changes and choose to download, print, or share your form.

Complete your Phfa Form 3 online today to take the first step towards your housing finance goals.

The CEO of the Pennsylvania Housing Finance Agency is commonly a professional with extensive experience in housing finance. As of my last update, it's beneficial to check their official website for the most current leadership information. A knowledgeable CEO leads initiatives to improve state housing resources, which significantly impacts programs like the PHFA Form 3. Staying informed about the agency's leadership can help you understand its mission and goals.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.