Get Sonyma Ff Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sonyma Ff Form online

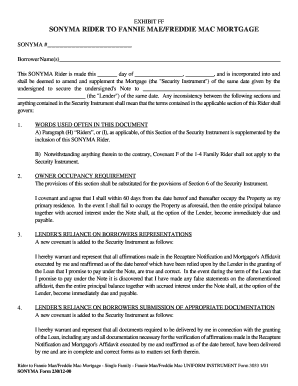

Completing the Sonyma Ff Form online requires careful attention to detail to ensure accuracy and compliance. This guide will provide a step-by-step process to help users navigate the form efficiently.

Follow the steps to complete the Sonyma Ff Form online.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Fill in the borrower names in the designated field, ensuring all names are spelled correctly and formatted as required.

- Indicate the date the form is being completed in the format provided. This date should reflect the current day, month, and year.

- In the 'Lender' section, provide the name of the lender as specified in your mortgage agreement.

- Complete the owner occupancy requirement section by confirming your commitment to occupy the property as your primary residence within the specified timeframe.

- Review the lender's reliance on borrower's representations and ensure that all affirmations made are true and correct.

- Provide all required documentation as mentioned in the form. Ensure that these documents are complete and correctly formatted.

- Complete the mortgage insurance section as instructed, noting that no consideration will be given to cancellation requests based on increased property value.

- If applicable, verify and complete the section regarding the transfer of property and assumptions to ensure compliance.

- After filling out all sections, review the form thoroughly for accuracy and completeness before proceeding to save or submit.

- Save changes, download a copy for your records, print, or share the completed form as needed.

Ready to complete your documents online? Start filling out the Sonyma Ff Form now!

Calculating income for mortgage qualification requires summing up all regular income sources, including wages, bonuses, and any other forms of income. It's vital to include consistent income streams while excluding irregular income that may not be dependable. Filling out the Sonyma Ff Form can help streamline this process, ensuring you capture all necessary details correctly. Understanding this calculation can empower you to present a robust case for mortgage approval.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.