Loading

Get 2012 Ca Form 3805z

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2012 Ca Form 3805z online

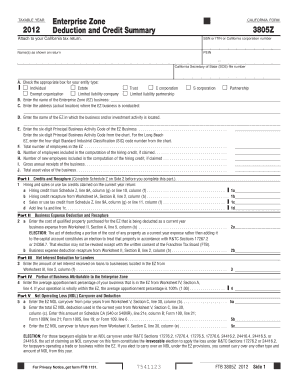

This guide provides a comprehensive overview for users on how to complete the 2012 Ca Form 3805z online. Designed to assist users with varying levels of experience, this step-by-step reference ensures clear understanding of each component of the form.

Follow the steps to effectively complete the form.

- Press the ‘Get Form’ button to access the form and open it in the appropriate editor.

- Enter your Social Security Number (SSN), Individual Taxpayer Identification Number (ITIN), or California corporation number at the top of the form.

- Provide the name(s) as they appear on your tax return in the designated field.

- If applicable, enter your Federal Employer Identification Number (FEIN) and the California Secretary of State (SOS) file number.

- Select the appropriate entity type by checking the corresponding box. Options include Individual, Estate, Trust, C corporation, S corporation, Partnership, Exempt organization, Limited liability company, or Limited liability partnership.

- Input the name of the Enterprise Zone (EZ) business in the provided space.

- Fill in the actual address where the EZ business is conducted.

- Indicate the name of the EZ in which the business or investment activity is located.

- Enter the six-digit Principal Business Activity Code associated with the EZ business. Refer to the provided chart for guidance.

- Input the total number of employees working in the EZ.

- If you are claiming the hiring credit, provide the number of employees included in its computation.

- Input the number of new employees included in the computation of the hiring credit, if claimed.

- Fill in the gross annual receipts for the business.

- Input the total asset value of the business.

- Complete sections detailing credits and recaptures as instructed, ensuring all necessary calculations are accurate.

- After filling out the form, you can review your entries for accuracy.

- Finally, save your changes, or choose to download, print, or share the completed form accordingly.

Get started on completing your documents online today!

Schedule CA 540 California Adjustments is used by residents to report adjustments related to income and deductions that differ from federal returns. This schedule is essential for accurately calculating your taxable income in California. Completing this schedule correctly is important, especially when filing the 2012 Ca Form 3805z to ensure compliance with state tax regulations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.