Loading

Get 2012 Amended It 203 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2012 Amended It 203 Form online

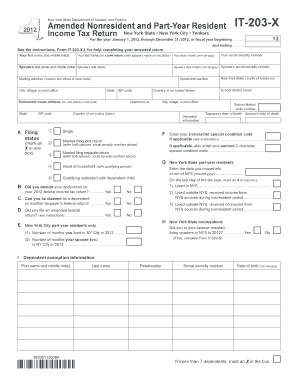

Filling out the 2012 Amended It 203 Form online can seem daunting, but with the right guidance, you can navigate each section with confidence. This guide provides clear and structured steps to help you complete the form accurately and efficiently.

Follow the steps to successfully complete your form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your last name and date of birth in the specified fields. For joint returns, make sure to include your spouse’s name on the line below.

- Fill in your mailing address, including the apartment number, state, and ZIP code. If your permanent home address is different, provide those details in the appropriate section.

- Select your filing status by marking an 'X' in the appropriate box. This determines how your income is reported and the deductions you may claim.

- Provide your social security number and your spouse's details if applicable, including their date of birth and social security number.

- Input your income details in the appropriate lines, such as wages, interest income, and any other sources of income. Make sure to refer to the respective federal forms if required.

- Complete the New York additions and subtractions sections by adding any relevant income or deductions according to your tax situation.

- Calculate your New York taxable income by subtracting the total deductions from your adjusted gross income.

- Review your tax computation and input any credits that you qualify for, ensuring that you add up your total New York taxes.

- Finish the form by indicating your desired method for receiving any potential refund and providing any additional information if required.

- Once you have filled out the form completely, save your changes, download the form for your records, and print or share it as needed.

Take control of your tax preparation by completing documents online with ease.

Form IT-203, Nonresident and Part-Year Resident Income Tax Return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.