Loading

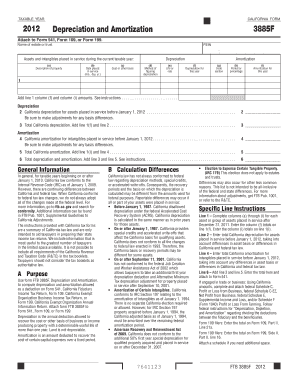

Get Taxable Year 2012 California Form 3885f Depreciation And Amortization Attach To Form 541, Form 109

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the taxable year 2012 california form 3885f depreciation and amortization attach to form 541, form 109 online

Filling out the taxable year 2012 california form 3885f is essential for users managing depreciation and amortization for their estate or trust. This guide will provide a step-by-step approach to ensure accurate completion of the form online.

Follow the steps to successfully complete the form online.

- Click ‘Get Form’ button to obtain the form and access it in an editable format.

- In the first section, provide the name of the estate or trust and the federal employer identification number (FEIN). This information is crucial for identifying the entity for which the form is being completed.

- List all assets and intangibles that were placed in service during the taxable year in the designated columns (a) through (i). Ensure you accurately describe each property, including the date placed in service, cost, method of depreciation, and amortization details.

- For line 1, sum the values of column (f) for depreciation and column (i) for amortization from the assets listed and enter these totals in the corresponding line.

- For assets placed in service before January 1, 2012, enter the total California depreciation on line 2, considering any basis differences as per the instructions.

- On line 4, enter the total California amortization for intangibles placed in service before January 1, 2012, again taking into account any necessary adjustments.

- Complete line 5 by adding the totals from line 1(i) and line 4 to get the total California amortization.

- Finally, on line 6, add the total depreciation from line 3 and the total amortization from line 5. This total should then be attached to Form 541, Form 109, or Form 199.

- After reviewing your entries for accuracy, save any changes, download, print, or share the completed form as necessary.

Start filling out your forms online to ensure accurate reporting and compliance.

Yes, California returns can be filed electronically. For the taxable year 2012 California Form 3885F Depreciation And Amortization Attach To Form 541, e-filing provides a convenient and efficient way to submit your returns. Check with your tax software or a professional service for compatibility with e-filing requirements.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.