Get Simple Ira Distribution Form - Alliancebernstein

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SIMPLE IRA Distribution Form - AllianceBernstein online

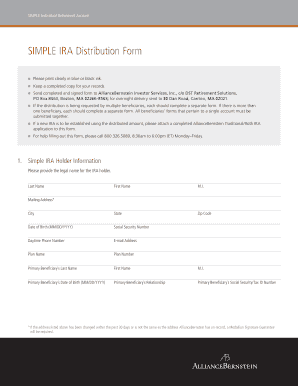

Completing the SIMPLE IRA Distribution Form online can streamline your distribution process. This guide provides clear and detailed instructions on filling out each section of the form to ensure accurate and timely processing.

Follow the steps to successfully complete your SIMPLE IRA Distribution Form.

- Click ‘Get Form’ button to obtain the form and open it.

- Provide your SIMPLE IRA holder information in Section 1. Enter your legal name, address, date of birth, Social Security number, daytime phone number, email address, plan name, and plan number. Include information about your primary beneficiary as well.

- In Section 2, indicate if you are the SIMPLE IRA account holder. If not, provide your name, daytime phone number, and select your capacity — such as attorney-in-fact or executor of the beneficiary.

- For Section 3, select the type of distribution you are requesting. Ensure you check the appropriate box to avoid defaults on the distribution type based on age.

- In Section 4, specify the payment amount — either a specific dollar amount or that you wish to liquidate the entire account.

- Review Section 5 to indicate your choice regarding tax withholding. You can choose to have federal income tax withheld or not, and you may specify a higher percentage if desired.

- Complete Section 6 by selecting your preferred payment method: check or electronic funds transfer (EFT). If choosing EFT, provide the necessary bank details.

- In Section 7, provide your signature to certify the information and actions taken on the form. Ensure all required signatories for your bank account also sign if applicable.

- After filling out all sections, save your changes, download the form, and print multiple copies for your records. Submit the completed form to AllianceBernstein as instructed.

Complete your SIMPLE IRA Distribution Form online today to ensure your distribution is processed efficiently.

An IRA distribution form is a document you fill out to request funds from your Individual Retirement Account (IRA). This form is essential for managing distributions, especially when considering a SIMPLE IRA Distribution Form - AllianceBernstein. It ensures your withdrawal follows the necessary compliance and tax guidelines. Accessing this form is straightforward through your account with AllianceBernstein, which helps facilitate your request.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.