Loading

Get Form 8833 Irs

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8833 IRS online

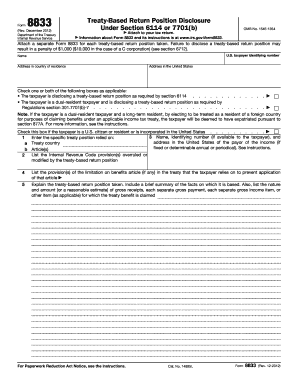

Filling out the Form 8833 is essential for taxpayers disclosing treaty-based return positions. This guide presents a step-by-step method for completing the form online, ensuring users understand each component and its requirements.

Follow the steps to fill out the Form 8833 online.

- Press the ‘Get Form’ button to access the form and open it in your preferred editor.

- Begin by entering your U.S. taxpayer identifying number. For individuals, this will typically be your social security number, while entities should provide their employer identification number.

- Fill in your name and address in the country of residence. Include city, province or state, and country, following that country’s postal code format.

- Complete the address in the United States, providing the current location where you receive correspondence.

- Check the applicable box or boxes to indicate whether you are disclosing a treaty-based return position under section 6114 or if you are a dual-resident taxpayer.

- In line 1, specify the treaty country related to your disclosure. In line 2, indicate the Internal Revenue Code provisions that are being overruled or modified by the treaty.

- In line 3, provide the name, identifying number (if available), and address in the U.S. of the income payor. Continue by checking the appropriate box that states whether you are a U.S. citizen or resident.

- In line 4, identify the limitation on benefits article from the treaty upon which you rely, if applicable.

- Line 5 requires an explanation of the treaty-based return position you are taking. Include a summary of the relevant facts and specify the nature and amount of gross receipts or payments for which you are claiming treaty benefits.

- Review all filled-out sections for accuracy. Once you are satisfied with the information, you have the option to save changes, download the completed form, print it, or share it as needed.

Complete your Form 8833 online today to ensure timely and accurate reporting.

The primary purpose of form 8833 is to disclose your claim of tax treaty benefits to the IRS. This form assists in documenting exemptions from US taxes that you are eligible for based on your country of residence and specific tax treaty provisions. By using form 8833, you can clearly communicate your tax positions, helping to avoid future disputes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.