Loading

Get Form As 2916 1

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form As 2916 1 online

Filling out the Form As 2916 1 online can be straightforward if you follow the right steps. This guide will provide you with detailed instructions to ensure you complete the form correctly.

Follow the steps to successfully complete the Form As 2916 1 online.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

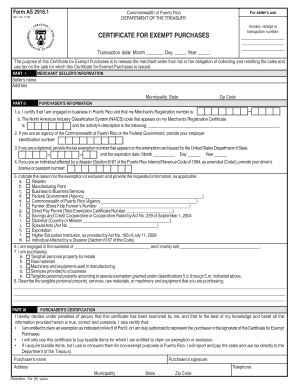

- Provide your business information in Part I, including the nature of your business and your Merchant's Registration number.

- In Part II, indicate the items you are purchasing by selecting the appropriate categories such as tangible personal property for resale or raw materials.

- Describe the tangible personal property, services, raw materials, or machinery and equipment you are purchasing, along with the seller's details.

- In Part III, certify the completion of the form by signing and providing the date of the transaction. Make sure the certifier is authorized to represent the purchaser.

- Review all the information entered to ensure accuracy and completeness.

- Finally, save changes, download, print, or share the completed form as necessary.

Complete your documents online to streamline your process.

Filling out an exempt status involves indicating the specific circumstances that warrant exemption from tax obligations. You will need to provide pertinent details about your situation and supporting documentation. The use of Form As 2916 1 can streamline this process, ensuring all necessary information is captured accurately.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.