Get Scdor Form Sc8857

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Scdor Form Sc8857 online

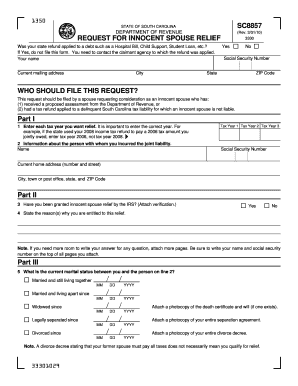

Filling out the Scdor Form Sc8857 is an important step for users seeking innocent spouse relief in South Carolina. This guide offers a comprehensive overview of the form's components and provides clear, step-by-step instructions to help users complete it efficiently online.

Follow the steps to successfully complete your Scdor Form Sc8857.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your name and current mailing address in the designated fields. Make sure the information is accurate, as it will be used for all official correspondence.

- Fill in your Social Security number, ensuring it is correctly entered, as this personal identifier is required for the application.

- In Part I, specify each tax year for which you seek relief, ensuring you input the correct years, particularly if a prior year's refund was applied to a current tax liability.

- Provide information about your spouse with whom you incurred joint liability, including their name and Social Security number.

- Indicate whether you have ever been granted innocent spouse relief by the IRS, and attach verification if applicable.

- Explain the reasons why you believe you are entitled to this relief in the provided space.

- In Part III, state your current marital status and provide any required documents corresponding to your situation, such as a death certificate, separation agreement, or divorce decree.

- Answer questions about any experiences of spousal abuse or domestic violence during the relevant tax years, attaching necessary documentation.

- Confirm whether you signed the tax returns and explain your involvement with the finances and preparation of those returns as instructed.

- Complete Part V by indicating the number of people in your household and detailing your average monthly income and expenses.

- Provide any additional information that may be necessary to support your request for relief.

- Finally, review the form for accuracy, sign it, and prepare to save changes, download, print, or share the completed document as needed.

Take action today by completing the Scdor Form Sc8857 online to request your innocent spouse relief.

To set up a payment plan with the South Carolina Department of Revenue, you can start by visiting their official website and navigating to the payment plan section. You will need to provide details about your tax liabilities and choose a payment schedule that fits your situation. If applicable, include relevant information from the Scdor Form Sc8857 to facilitate your request. Establishing a payment plan can help you manage your tax obligations more effectively.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.