Loading

Get 73a801

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 73A801 online

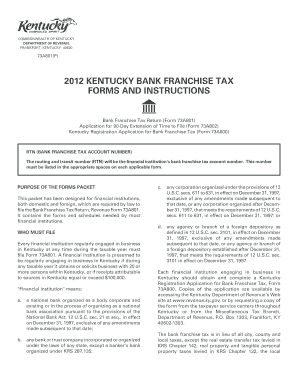

Filling out the 73A801 form can be a straightforward process if you follow the right steps. This guide is designed to help you navigate the requirements and ensure you complete the form accurately and efficiently.

Follow the steps to successfully complete the 73A801 form.

- Click the 'Get Form' button to access the document and load it in the online editor.

- Enter the Routing and Transit Number (RTN), which serves as the financial institution's tax account number, in the designated field at the top of the form.

- Provide the financial institution's legal name, mailing address, and federal identification number in the specified sections.

- Check the appropriate box to indicate whether you are submitting an original return or an amended return.

- Begin the computation section by inputting the total net capital, as derived from Schedule B, line 7. Ensure that this value is accurate and reflects the institution's financial status.

- Calculate and enter the apportionment percentage from Schedule C, line 11 in the next line.

- Multiply the total net capital by the apportionment percentage to find the taxable net capital.

- Determine the tax liability by multiplying the taxable net capital by the tax rate of 1.1 percent, or enter the minimum tax of $300, whichever is larger.

- If applicable, include any credits such as the Kentucky Investment Fund Act Credit or the Kentucky Historic Preservation credit. Enter this amount in the provided field.

- Subtract any credits from the tax liability to find the total tax liability after credit.

- Include any adjustments, interest, and penalties as instructed on the form.

- Calculate the total liability by summing the relevant lines and enter this at the bottom of the computation section.

- Complete the payment section, entering the amount paid with the extension or original return.

- If there is an overpayment, indicate the amount and explain how to proceed with that in the appropriate section.

- Review the information for accuracy and ensure all fields are complete before signing the form.

- Submit the completed form by mailing it to the Kentucky Department of Revenue along with any required payment.

Complete your bank franchise tax return online today to ensure compliance and avoid any penalties.

You can obtain your RT number from the Franchise Tax Board either by calling their customer service or checking your previous tax documents. It's crucial to have your tax identification details handy to facilitate this process smoothly. If you struggle to find it, using platforms like US Legal Forms can assist you in organizing your tax information more effectively and ensure you don't miss important details.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.