Get Application For Long-term Loan Or Guarantee - Export-import Bank Of ... - Exim

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Application For Long-term Loan Or Guarantee - Export-Import Bank Of ... - Exim online

Completing the Application For Long-term Loan Or Guarantee with the Export-Import Bank can seem daunting. This guide will help you navigate the process step-by-step, ensuring that you provide all necessary information accurately and efficiently.

Follow the steps to successfully complete your application form.

- Click 'Get Form' button to access the application form and open it in your preferred editor.

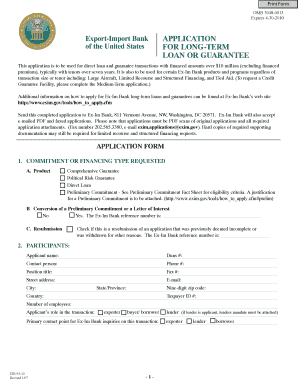

- Begin by selecting the type of commitment or financing requested in Section 1. Tick the applicable product box that describes your loan or guarantee needs.

- Complete the Participants section, detailing the applicant name, contact information, and relevant identifiers such as Duns# and Taxpayer ID #.

- Identify all participants involved in the transaction, including exporters, suppliers, borrowers, guarantors, buyers, end-users, and lenders. Provide their details in the respective fields.

- Move to Section 3 to specify the details of coverage requested. Carefully check all applicable boxes relevant to your transaction and attach necessary forms as instructed.

- Describe the transaction in Section 4. Provide detailed information about the goods and services involved, the purpose of the transaction, and any associated project details.

- Outline the requested financing amounts and structure in Section 5 by filling out the chart accurately, capturing all eligible amounts.

- Provide the reason for requesting Ex-Im Bank support in Section 6. Select the applicable option that explains why the bank’s assistance is necessary.

- Attach all required credit information, general information, certifications, and any other attachments as outlined in subsequent sections.

- Review your completed application, ensuring all fields are filled out correctly and all required documents are attached.

- Finally, save your changes, and choose whether to download, print, or share the completed form as needed.

Complete your application online today and take the first step toward securing a long-term loan or guarantee.

The Chinese EXIM Bank has been cautious about extending concessional loans due to concerns about debt sustainability and repayment capabilities of borrowing countries. Additionally, geopolitical factors and policy shifts play a role in their lending practices. This cautious approach reflects a broader strategy to manage financial risks associated with international loans. Understanding these dynamics can help U.S. businesses better navigate their own financing options, like an application for a long-term loan or guarantee with the EXIM.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.