Get Form 1300a

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 1300a online

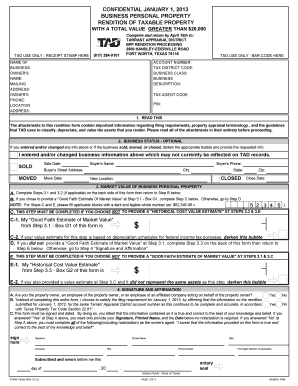

Completing the Form 1300a online is a straightforward process that enables users to report their business personal property for tax appraisal purposes. This guide provides a step-by-step approach to help individuals and businesses fill out this important document accurately and efficiently.

Follow the steps to complete the Form 1300a online.

- Click ‘Get Form’ button to obtain the form and open it for completion.

- Begin by entering the business name and owner's information in the designated fields. Ensure that the mailing address is accurate, as this will be used for future correspondence.

- Provide contact information, including the owner's phone number and the location address of the business property. This information is essential for validation and communication.

- Indicate the business status — whether it has been sold, moved, or closed. Darken the appropriate bubble and provide the necessary details, including sale or move dates and new addresses.

- Enter the market value of business personal property. Complete the 'Good Faith Estimate of Market Value' if applicable. If this is not provided, proceed to the historical cost value estimate.

- If opting to include a historical cost estimate, fill out the required sections for historical cost and depreciation information based on the type of assets owned.

- After completing the required sections, review all information entered to ensure accuracy and completeness.

- Finalize your submission by signing and dating the form in the designated signature area. Ensure all declarations are properly acknowledged.

- Once you have completed filling out the form, save your changes. You can then download, print, or share the form as needed.

Begin filing your Form 1300a online today to ensure compliance and accurate reporting.

To submit Form 1310 to the IRS, choose either electronic filing through approved software or mail your completed form to the appropriate address provided in the IRS instructions. If you opt for mailing, use a secure method; consider certified mail for tracking purposes. With resources available on uslegalforms, you can review the steps to ensure your submission is accurate and timely.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.