Loading

Get Tlfa

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tlfa online

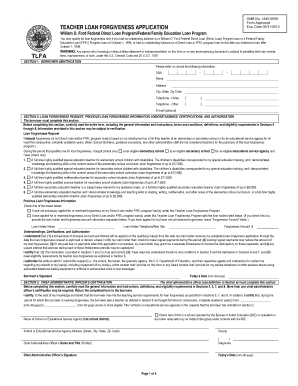

The Teacher Loan Forgiveness Application (Tlfa) is an important document for educators seeking loan forgiveness under the Teacher Loan Forgiveness Program. This guide provides step-by-step instructions to help you navigate the form easily and ensure your application is filled out correctly.

Follow the steps to complete the Tlfa form online.

- Click ‘Get Form’ button to begin the process of obtaining the Tlfa form online.

- In Section 1, enter or correct your borrower identification information, including your Social Security Number, name, address, and contact details.

- Proceed to Section 2, where you must request loan forgiveness. Indicate your employment status as a full-time teacher and specify the type of school or educational service agency where you taught.

- Next, select the checkbox that describes your qualifications as a teacher, based on the criteria provided, to determine your potential loan forgiveness amount.

- In the Previous Loan Forgiveness Information section, check the appropriate option regarding any previous applications you may have submitted for loan forgiveness.

- Review the Understandings, Certifications, and Authorization section carefully. Confirm that all information provided is true and sign the section data field.

- Section 3 requires the chief administrative officer’s certification. Ensure this section is completed by your school’s chief administrative officer, verifying your eligibility and teaching service.

- Once all applicable sections are filled out, review your application for completeness and accuracy. Save the changes you made to the form.

- Download, print, or share the completed form as necessary and follow the instructions provided in Section 9 for submission.

Start your application for loan forgiveness by filling out the Tlfa online today.

The choice between TLF and PSLF often depends on your specific financial situation and career goals. TLF offers more flexible repayment options and a broader eligibility base than PSLF. However, PSLF can provide significant benefits to those in public service careers. It is important to evaluate both programs thoroughly to determine which best aligns with your circumstances.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.