Loading

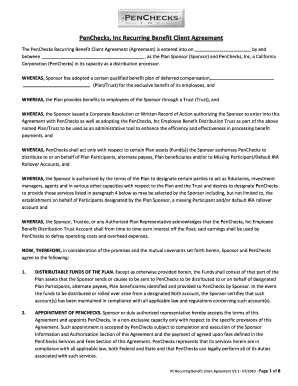

Get Penchecks, Inc Recurring Benefit Client Agreement

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PenChecks, Inc Recurring Benefit Client Agreement online

Filling out the PenChecks, Inc Recurring Benefit Client Agreement online is a streamlined process designed to enhance your efficiency in the management of benefit distributions. This guide provides step-by-step instructions tailored to users of all experience levels.

Follow the steps to complete your agreement with confidence.

- Click ‘Get Form’ button to access the PenChecks, Inc Recurring Benefit Client Agreement. This action will allow you to open the form in an online editor for your convenience.

- Review the form’s introductory section, which outlines the agreement between the Plan Sponsor and PenChecks, Inc. Ensure you understand the basic terms and responsibilities outlined in the initial clauses.

- Proceed to the 'Distributable Funds of the Plan' section. Here, you need to specify the funds that the Sponsor intends to distribute to designated Plan Participants. Ensure all relevant accounts are included.

- In the 'Appointment of PenChecks' section, indicate your acceptance of the agreement terms. This may include providing necessary authorization and confirming adherence to the fees outlined in the PenChecks Services and Fees section.

- Review and fill out the 'Missing Participant / Default IRA Compliance' section. If applicable, state how PenChecks will manage accounts for missing participants in compliance with Department of Labor standards.

- Complete the 'Authority of PenChecks' section. Specify what authority is granted to PenChecks, including how they will manage funds and process distributions.

- Fill in the 'Sponsor Information & Authorization' section. Enter the required details such as company name, contact person, and relevant trust and TPA information. Make sure to provide accurate and complete information.

- Sign the agreement digitally. You will need to provide your printed name, title, date, and an authorized signature to complete the agreement.

- Finally, save your completed form. You can download, print, or share the agreement directly from the online editor to ensure you have a copy for your records.

Take the next step and file your PenChecks, Inc Recurring Benefit Client Agreement online today!

Some of the disadvantages of rolling over a 401(k) into an IRA include no loan options, a decrease in creditor protection, possibly higher fees, and the loss of a possible earlier withdrawal without penalty.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.