Get Form 4461

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 4461 online

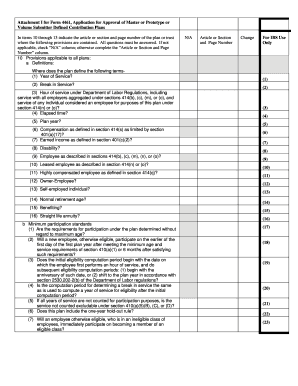

Form 4461 is essential for applying for approval of master or prototype or volume submitter defined contribution plans. Completing this form accurately is crucial for ensuring compliance with tax regulations. This guide will walk you through the necessary steps to fill out Form 4461 online effectively.

Follow the steps to complete Form 4461 online.

- Click ‘Get Form’ button to obtain the form and open it in your editor.

- In items 10 through 13, you will need to indicate the article or section and page number of the plan or trust for specific provisions. Answer all questions; if not applicable, check the 'N/A' column.

- For each provision listed under item 10, provide the relevant definitions and standards as required. This includes definitions for terms like 'year of service', 'break in service', and more.

- Continue to complete employer contribution specifics, ensuring uniform formulas where relevant and answering all inquiries with respect to the plan's design.

- In sections addressing employee contributions and distribution provisions, respond clearly to all alignment with the necessary legal guidelines.

- Double-check each section for accuracy and completeness before saving your changes. Use online tools to ensure no fields are missed.

- Finally, you can save changes, download, print, or share the completed form as needed.

Complete your Form 4461 online today to ensure timely compliance with IRS requirements.

Form 8889 is typically issued by the account manager if you have a Health Savings Account (HSA). If you have not received it, it's advisable to check with your HSA provider directly. Also, you can find resources on platforms like USLegalForms that help you understand how to manage and file this form, ensuring you have all necessary documentation for tax purposes.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.