Get State Of Georgia Department Of Revenue

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the State Of Georgia Department Of Revenue online

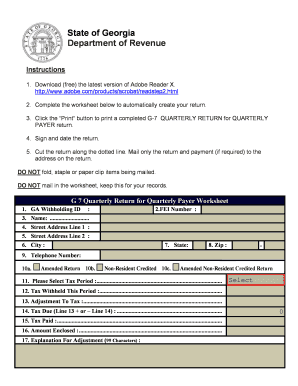

This guide provides a comprehensive overview of filling out the State Of Georgia Department Of Revenue form online. Whether you are new to filing taxes or have experience, these step-by-step instructions will assist you in completing your form accurately.

Follow the steps to successfully complete your tax return.

- Click ‘Get Form’ button to obtain the form and open it for completion.

- Begin by entering your GA withholding ID in the designated field. This is essential for identifying your account with the Georgia Department of Revenue.

- Input your FEI number in the following field. This number is used for federal identification and is necessary for tax purposes.

- Provide your name in the ‘Name’ field. Ensure the name matches your tax records for accuracy.

- Fill in your street address on the first and second address lines as needed. Accurate address information is crucial for correspondence.

- Indicate your city, state, and zip code in the respective fields to complete your address details.

- Enter your telephone number for any potential follow-up or inquiries regarding your return.

- If applicable, check the appropriate boxes regarding whether you are filing an amended return or a non-resident credited return.

- Select the tax period for which you are filing. This ensures your return is processed in the correct timeframe.

- Complete the section detailing the tax withheld for the period, adjustments to tax, the total tax due, and the tax paid.

- If you have adjustments, provide an explanation in the space indicated. Keep it concise within the character limit provided.

- Once all fields are filled out, review your information for accuracy before submitting the form.

- After review, you can save changes, print the form, or share it as needed. Ensure you sign and date the return as per requirement.

Start filling out your Georgia Department of Revenue form online today for a smoother filing experience.

No, the Georgia Department of Revenue and the IRS are not the same entity. The State Of Georgia Department Of Revenue handles state tax matters, such as income tax, sales tax, and property tax, specific to Georgia. In contrast, the IRS is the federal agency responsible for tax collection and enforcement at the national level. Understanding the distinction between these two agencies can help you navigate your tax responsibilities more effectively and accurately.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.