Loading

Get Massachusetts Schedule 2k 1 Instructions

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Massachusetts Schedule 2k 1 Instructions online

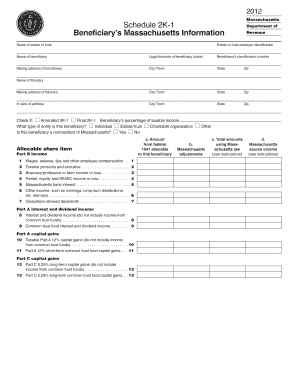

Filling out the Massachusetts Schedule 2k 1 form can seem daunting, but with careful attention to each section, users can complete it confidently. This guide provides a clear and supportive approach to navigating the instructions online.

Follow the steps to complete your form online effectively.

- Select the ‘Get Form’ button to access the Massachusetts Schedule 2k 1 form and open it in your editing software.

- Enter the name of the estate or trust at the top of the form. This identifies the entity for which the form is being filed.

- Fill in the estate or trust employer identification number. This is important for tax identification purposes.

- Provide the name of the beneficiary. This should be the individual or entity receiving income from the trust.

- Indicate the legal domicile of the beneficiary by entering the state in which they reside.

- Add the beneficiary’s identification number, ensuring accuracy as this identifies the taxpayer.

- Complete the mailing address for the beneficiary, including city/town, state, and zip code.

- Fill out the mailing address for the fiduciary, ensuring all required fields are completed accurately.

- Check if the form is amended or final by marking the appropriate selection.

- Indicate the beneficiary’s percentage of taxable income from the estate or trust.

- Select the type of entity for the beneficiary, such as individual, estate/trust, or charitable organization.

- Answer whether the beneficiary is a nonresident of Massachusetts by marking yes or no.

- Provide details for income components under Part B, ensuring to itemize any other income as required.

- Detail any deductions allowed and ensure all amounts are based on Massachusetts law.

- Complete sections related to credits and estimated tax payments, providing necessary certificate numbers where applicable.

- Review all entered data for accuracy before finalizing the form.

- Once you have filled out the form completely, save your changes, and choose to download, print, or share the document as needed.

Complete your Massachusetts Schedule 2k 1 form online today to ensure accurate filing and compliance!

You should file Massachusetts Form 1 by mailing it to the Massachusetts Department of Revenue at the address specified for your residency type. Be sure to check the latest guidelines on their website for any updates or changes in the filing process. When you file your form and adhere to the Massachusetts Schedule 2k 1 Instructions, you can avoid delays and potential penalties.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.