Loading

Get A Death Certificate Must Be Attached To Form Ri-4768 ... - Tax Ri

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the A DEATH CERTIFICATE MUST BE ATTACHED TO FORM RI-4768 ... - Tax Ri online

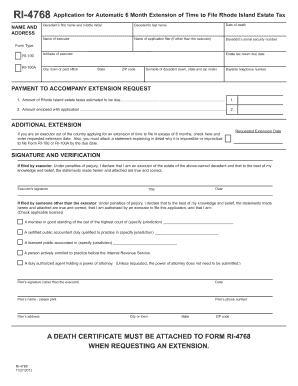

Filling out the RI-4768 form is an essential step in applying for an extension of time to file Rhode Island estate tax returns. This guide provides clear instructions to ensure you complete the form correctly and attach the required documentation.

Follow the steps to effectively complete the form.

- Press the ‘Get Form’ button to obtain the form and open it in your preferred editor.

- In the 'Name and Address' section, enter the decedent’s first and last name, middle initial, date of death, social security number, and the name and address of the executor.

- Indicate the form type by checking the appropriate box for RI-100 or RI-100A.

- Fill in the estate tax return due date, including the domicile of the decedent and your contact details.

- Complete the 'Payment to Accompany Extension Request' section by entering the estimated amount of Rhode Island estate taxes due and the amount you are enclosing with the application.

- If you are an executor out of the country requesting an additional extension, check the appropriate box and provide the requested extension date.

- Sign and date the form in the 'Signature and Verification' section. Ensure that the form is signed by the executor or the authorized filer, depending on who is submitting the application.

- Attach the required death certificate to the form before submission.

- Submit the completed form to the Rhode Island Division of Taxation, Estate Tax Section at the provided address.

- After submission, await a response letter from the Division of Taxation granting or denying your extension request.

Complete your documents online for a streamlined filing experience.

Filling out taxes for a deceased person requires careful attention to detail. You should use the deceased’s final income information, report any income earned up to the date of death, and complete the appropriate tax forms. Don’t forget that a death certificate must be attached to Form RI-4768 ... - Tax Ri to support your filing and clarify the taxpayer's status.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.