Get Plan Of Distribution Of Trust Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Plan Of Distribution Of Trust Form online

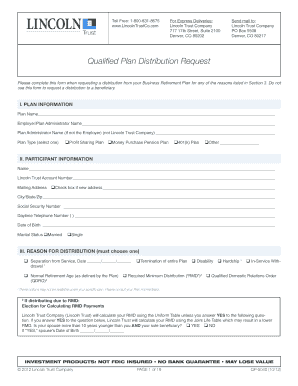

Filling out the Plan Of Distribution Of Trust Form online requires careful attention to detail to ensure accurate processing. This guide will walk users through each section of the form, providing clear instructions for individuals with varying levels of experience.

Follow the steps to complete your form accurately.

- Click the ‘Get Form’ button to access the Plan Of Distribution Of Trust Form and open it in your preferred editor.

- Begin by providing your plan information. This includes the Plan Name, Employer/Plan Administrator Name, and Plan Type. Be sure to select the correct type of plan from the available options.

- Next, input participant information. Fill in your Name, Lincoln Trust Account Number, Mailing Address, City/State/Zip, Social Security Number, Daytime Telephone Number, and Date of Birth. Mark the appropriate Marital Status.

- Indicate the reason for the distribution by selecting one option from Section III and including the relevant date if applicable. Ensure to review available options specific to your plan.

- If applicable, complete the section regarding Mandatory Annuity Election, especially if it relates to a Money Purchase Pension Plan. Obtain spousal consent, if needed, for any waivers.

- Proceed to Payment Options/Asset Instructions, where you can select how you want your distribution processed. Choose from options such as Direct Rollover or Cash Distribution, filling in necessary details as indicated.

- In Section VI, specify your Tax Withholding preferences. Confirm federal and state withholding choices, ensuring you understand how your selections may impact your distribution.

- Complete the Participant Acknowledgment section by signing and dating the form. Ensure all statements are accurate before submitting.

- If required, the Plan Administrator must also review and sign the form in the designated section.

- Finally, review the entire form for accuracy. Save your changes, download a copy for your records, and print or share the form as needed before submission.

Ensure all parts of your Plan Of Distribution Of Trust Form are completed accurately for effective online processing.

Related links form

To report a distribution from a trust, you start by gathering the necessary documentation, including the Plan Of Distribution Of Trust Form. This form helps in detailing the amounts distributed to each beneficiary and the corresponding tax implications. Ensure that you also complete Form 1041 for the trust, and provide beneficiaries with Schedule K-1 for their personal tax returns. Adhering to these steps can simplify your reporting process and maintain compliance with IRS requirements.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.