Get Hsa Payroll Deduction Form - Ohr Gatech

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the HSA Payroll Deduction Form - Ohr Gatech online

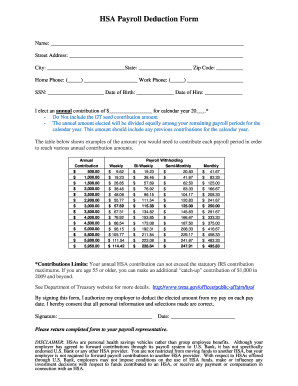

The HSA Payroll Deduction Form - Ohr Gatech is an essential document for users to elect their health savings account contributions through payroll deductions. This guide provides step-by-step instructions to ensure that you fill out the form accurately and efficiently.

Follow the steps to complete the HSA Payroll Deduction Form online.

- Click ‘Get Form’ button to obtain the form and open it in an editor for modification.

- Begin by filling in your name in the designated field at the top of the form.

- Provide your street address, city, state, and zip code in the corresponding fields to ensure accurate identification.

- Enter your home and work phone numbers in the specified sections for easy contact.

- Fill in your Social Security Number (SSN) to comply with IRS regulations.

- Indicate your date of birth and date of hire, as these details might be necessary for establishing your eligibility.

- Elect an annual contribution amount for the HSA for the calendar year. Make sure to not include any GT seed contributions in this amount.

- Refer to the provided table to understand how your chosen annual contribution will be divided over the remaining payroll periods.

- Sign and date the form at the bottom to authorize your employer to deduct the specified amount from your pay.

- Once completed, return the form to your payroll representative for processing.

Take the first step towards managing your health savings online by filling out the form today.

To set up direct deposit at Georgia Tech, you need to complete the Direct Deposit Authorization form available through the payroll office. After you fill it out, submit it alongside any necessary documentation to ensure your checks go directly into your bank account. This is particularly useful when managing benefits like the HSA Payroll Deduction Form - Ohr Gatech, as it streamlines your finances. Setting up direct deposit can enhance your budgeting and keep your financial transactions organized.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.