Loading

Get Bankruptcy Forms

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Bankruptcy Forms online

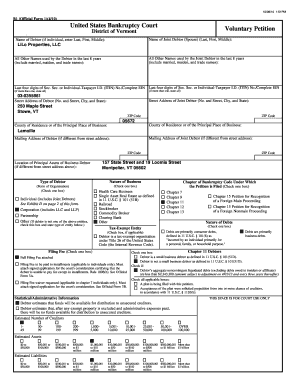

Filing for bankruptcy can be a complex process, but with the right guidance, you can navigate the Bankruptcy Forms online with confidence. This guide aims to provide clear instructions on how to complete these forms effectively and accurately.

Follow the steps to successfully fill out your bankruptcy forms online.

- Click ‘Get Form’ button to obtain the bankruptcy form and open it in your chosen editor.

- Begin by entering the names of the debtors, including any joint debtors, in the respective fields provided. Ensure that you include last names, followed by first and middle names as applicable.

- Next, fill in any other names used by the debtor in the last eight years. This should include marital names, maiden names, and any trade names.

- Provide the last four digits of the Social Security number or Individual Taxpayer Identification Number (ITIN) in the designated fields for each debtor. If more than one applies, list all applicable numbers.

- Input the address of the debtor and joint debtor. Make sure to include the street address, city, state, and ZIP code accurately.

- Select the type of debtor from the options provided, which may include individual, corporation, partnership, or another entity. This step is crucial for classification under the right chapter of bankruptcy.

- Indicate the chapter of the Bankruptcy Code under which you are filing. Options typically include Chapter 7, 11, 12, and 13.

- If applicable, select whether you are requesting a fee waiver or intending to pay your filing fee in installments. Include any required applications as stated.

- List all estimated creditors and provide an estimation of the number. Include a breakdown of estimated assets and liabilities in the appropriate fields.

- Complete the schedule of all previous bankruptcy cases filed within the last eight years if applicable, including case numbers and dates.

- Make sure to review all information entered for accuracy and completeness. Once you are satisfied with the entries, you can save changes, download, print, or share the form as needed.

Complete your bankruptcy forms online today and take the first step towards financial relief.

For many individuals, Chapter 7 bankruptcy is often considered the easiest form of bankruptcy. This process allows you to discharge most of your debts quickly with minimal paperwork. However, you still need to fill out standard Bankruptcy Forms to kick off the process. Using a platform like uslegalforms can simplify your experience, guiding you through the necessary documentation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.