Get Pd5 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Pd5 form online

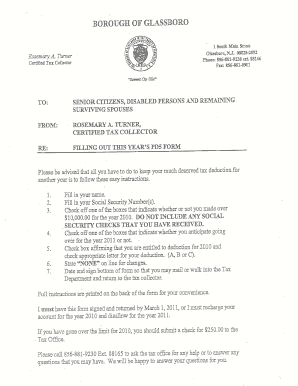

The Pd5 form is an essential document for qualified New Jersey residents seeking to confirm their eligibility for a real property tax deduction. This guide provides clear and comprehensive steps to help users complete the form accurately and efficiently online.

Follow the steps to fill out the Pd5 form with ease.

- Click ‘Get Form’ button to access the Pd5 form and open it in your preferred editing application.

- In the first section, provide the names of all recipients of the real property tax deduction. Ensure the names are spelled correctly as they appear on official documents.

- For the income confirmation section, declare whether your combined total annual income, along with your spouse or civil union partner, did not exceed or did exceed $10,000 for the previous tax year. Be precise when selecting your answer.

- Reaffirm your eligibility by confirming that the previously provided information about domicile, legal residence, marital or civil union status has not changed. Select one of the provided options: A, B, or C, and list any changes if necessary.

- Finally, sign and date the form at the designated area to certify that the information is true to the best of your knowledge. Ensure you comply with all requirements to avoid potential penalties.

- Once you have completed all sections, review your entries for accuracy. After confirming all information is correct, you can save your changes, download the form, print a copy, or share it as needed.

Complete the Pd5 form online today to ensure you maintain your property tax deduction eligibility.

In Hawaii, property tax exemptions generally apply to homeowners who are seniors, disabled veterans, or those receiving certain public assistance. To ascertain your eligibility, you should fill out the Pd5 Form, which collects relevant details about your property and your status. By doing so, you can receive important tax relief. Be sure you understand the criteria outlined by your local tax office to benefit from these exemptions.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.