Get Chaseoverdraftsettlement Payout Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Chaseoverdraftsettlement Payout Form online

Filling out the Chaseoverdraftsettlement Payout Form online can be a straightforward process if you follow the detailed instructions provided. This guide will offer clear, step-by-step directions to assist you in submitting your claim effectively.

Follow the steps to successfully complete your Chaseoverdraftsettlement Payout Form online.

- Click 'Get Form' button to obtain the form and open it in your preferred online editor.

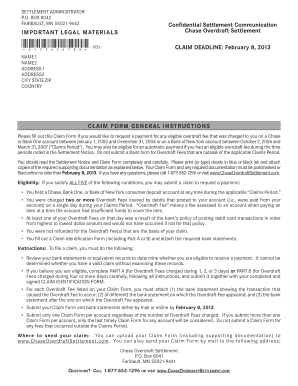

- Carefully read the Claim Form general instructions and eligibility requirements to ensure you qualify for the payout.

- Begin filling out the Claim Identification Form. Enter your personal information including your first name, last name, address, and email clearly in the designated fields.

- Indicate if there are additional account holders by providing their names in the appropriate sections.

- Sign the form to certify all submitted information is accurate and that the overdraft fees being claimed were not refunded.

- If you are claiming overdraft fees incurred over 1 to 3 days, complete Part A of the form and list all relevant overdraft fees, ensuring you attach the required bank statements.

- For claims involving overdraft fees on 4 or more days, complete Part B and follow instructions to fill out the Overdraft Fee Worksheet, attaching bank statements as necessary.

- Once all parts are completed, ensure that all required bank statements and documentation are included.

- Save your entries, then submit your filled form and attachments either online or via mail before the claim deadline.

Start filing your Chaseoverdraftsettlement Payout Form online today to ensure your claim is considered.

The Chase overdraft lawsuit addresses claims that Chase Bank assessed excessive overdraft fees on its customers' accounts. These fees often occurred due to transactions that pushed accounts into negative balances without proper notification. Many customers sought compensation through the Chaseoverdraftsettlement Payout Form, which provides a pathway for those affected to claim refunds. Ultimately, this legal action aims to promote transparency and fair banking practices.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.