Get Alabama Ppt 2013 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Alabama Ppt 2013 Form online

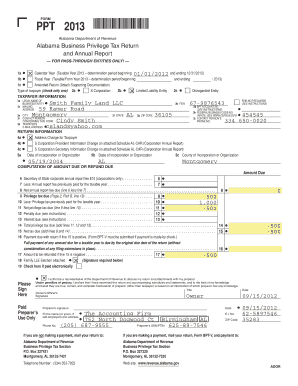

The Alabama Ppt 2013 Form is essential for pass-through entities to report and pay the Alabama Business Privilege Tax. This guide provides step-by-step instructions to assist users in accurately filling out the form online, ensuring compliance and proper submission.

Follow the steps to complete the Alabama Ppt 2013 Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Select the applicable taxable year for your entity. Choose between calendar year or fiscal year based on your entity's specific circumstances.

- Indicate if this is an amended return by selecting the appropriate option, and make sure to attach any necessary supporting documentation.

- Mark the appropriate type of taxpayer by checking only one of the provided boxes: S Corporation, Limited Liability Entity, or Disregarded Entity.

- Enter the legal name of the business entity, mailing address, and all required contact information, including email and phone number.

- Provide the Federal Employer Identification Number (FEIN) or indicate that a FEIN is not required as per instructions.

- Complete the Return Information section, including any address changes and corporation president or secretary information if applicable.

- Fill in detailed financial information to compute the amount due or refund due. This section includes entering values for annual report fees, privilege taxes, and any applicable penalties or interest.

- Sign and date the form, authorizing any representative to discuss the return with the preparer.

- Once all sections are completed, save your changes, download the form, and prepare to print or share as necessary.

Complete your documents online promptly to ensure compliance with Alabama's tax regulations.

The Alabama partnership extension form is used by partnerships to request an extension on their tax filings. This form allows more time to prepare your returns while ensuring you're still compliant with state requirements. Filing the Alabama PPT 2013 form when due is essential, but if you need extra time, the partnership extension form is the way to go. For assistance, you can refer to resources on uslegalforms.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.